NEW YORK, Feb 25 (Reuters) – Stocks around the world were rebounding on Friday and U.S. Treasuries were out of favor as investors welcomed coordinated Western sanctions on Russia that targeted its banks but not did not block it from a global payments system and left its energy sector largely untouched.

Oil prices were lower on Friday as concerns about supply disruptions eased a day after oil surpassed $100 a barrel for the first time since 2014 following Russia’s invasion of Ukraine.

European shares rallied and Wall Street’s indexes extended Thursday’s rally. However, indexes were still down significantly from where they were at the end of last week.

Register now for FREE unlimited access to Reuters.com

Register

The MSCI World Index (.MIWD00000PUS) was up 2.18% on Friday but down for the week — after investors sold off earlier in the week due to Russian President Vladimir Putin’s decision to attack Ukraine.

Putin on Friday urged Ukraine’s military to overthrow its political leaders and negotiate peace, as authorities in Kyiv called on citizens to help defend the capital from a Russian assault its mayor said had already begun. read more

EU countries agreed to freeze European assets belonging to Putin and his foreign minister, Sergei Lavrov, on Friday, as Ukrainian President Volodymyr Zelenskiy pleaded for faster and more forceful sanctions. The United States was also expected to impose sanctions on Putin as soon as Friday, according to a CNN report citing people familiar with the decision. read more

Some investors, however, were wary of the quick return to favor of riskier assets, just weeks before the U.S. Federal Reserve is expected to raise interest rates.

“The market is purely looking at the short run, saying that what they feared has happened so there’s nothing else to fear on the invasion of Ukraine … that’s being pretty shortsighted,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte, North Carolina.

Zaccarelli is turning his focus on “what the Federal Reserve is going to do. That’s a larger threat to markets. … The Fed is going to have to raise rates to a higher level than people believe in order to combat inflation.”

The Dow Jones Industrial Average (.DJI) was up 2.2% after closing 0.28% higher on Thursday while the S&P 500 (.SPX) gained 1.86% after rising 1.5% in the previous day’s session and the Nasdaq Composite (.IXIC) added 1.03% after rallying 3.3% on Thursday.

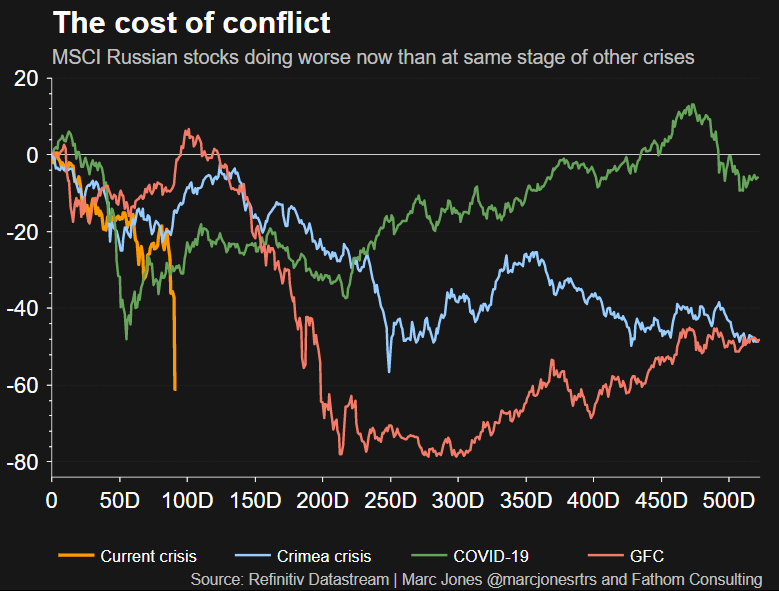

Russia’s main stock index (.IMOEX) closed up 20% on Friday after Thursday’s record 33% drop. Gains pared somewhat in after-hours trading (.IMOEX2) with the index last up 15%.

A red London bus passes the Stock Exchange in London, Britain, February 9, 2011. REUTERS/Luke MacGregor/File Photo

Read More

OIL PRICES DROP

Oil prices fell as investor nervousness about supply disruptions eased. Brent crude was last at $97.76 per barrel, down 1.33%, while U.S. West Texas Intermediate crude settled down 1.3% at $91.59.

Safe haven gold dropped 0.7% to $1,889.94 an ounce. On Thursday it had jumped to $1,973.96, its highest level since September 2020.

Reflecting the relative calm in financial markets, yields on 10-year U.S. Treasuries steadied after a slide to 1.846% in the previous day’s session. read more

The yield on 10-year Treasury notes was up 1.9 basis points to 1.991%. The yield on the 30-year Treasury bond was up 0.5 basis points to 2.298%. The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was up 5.4 basis points at 1.600%.

After some dramatic moves in foreign exchange markets on Thursday, currency prices were much calmer.

The U.S. dollar dipped a day after notching its biggest one-day percentage gain in more than three months, as investors gauged the latest round of sanctions on Russia and U.S. inflation data was viewed as likely to keep the Fed from being overly aggressive at its next policy meeting. read more

The dollar index fell 0.464%, with the euro up 0.6% to $1.1258. The Japanese yen weakened 0.08% versus the greenback to 115.63 per dollar, while Sterling was last trading at $1.3403, up 0.21% on the day.

The Russian rouble strengthened to 83.21 per dollar, clawing back from the previous session’s record low of 89.986.

U.S. economic data on Friday showed consumer spending increased more than expected in January even as price pressures mounted, with annual inflation hitting rates last seen four decades ago. read more

“The revisions to income and spending data shows the economy was very resilient to Omicron and to high oil prices. Hopefully, the situation with Russia is short-lived, but even if oil prices stay elevated, the economy should have enough fundamental strength to tolerate high energy prices,” said Brian Jacobsen, senior investment strategist at Allspring Global Investments in Menomonee Falls, Wisconsin.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Sinead Carerw; additional reporting by Chuck Mikolajczak, Tommy Wilkes and Sujata Rao

Editing by William Maclean, Elaine Hardcastle and Jonathan Oatis

Our Standards: The Thomson Reuters Trust Principles.