World Bank President David Malpass says the U.S. and Europe has put in ‘strong sanctions,’ and it impacts world oil trade and food.

The S&P Goldman Sachs Commodity index jumped 19.9%, its best weekly gain on record, per the Dow Jones Market Data Group, as Russia invaded Ukraine spiking uncertainty over the future of oil, wheat, corn, and other commodities.

RUSSIA INVADES UKRAINE: LIVE UPDATES

S&P Goldman Sachs Commodity Index (Google Finance )

“The U.S. has put in strong sanctions, Europe has put in strong sanctions, and it affects world oil trade and also food. The food trade, which is so important both Russia and Ukraine were big providers of food” said David Malpass, President of the World Bank, during an interview with FOX Business’ Neil Cavuto.

“And now as banks stop working with Russia, then it changes the trade lines going on. China may be able to make up for some of that by day, buy some of the oil, some of the wheat from Russia. But in for the total world, it’s a huge supply shock that’s going on” he warned.

This in turn sent investors into the safe haven of gold and out of U.S. stocks.

The S&P 500 and Dow Jones Industrials wrapped the fourth week of declines, while the Nasdaq Composite closed lower for three of the past four.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 33614.8 | -179.86 | -0.53% |

| SP500 | S&P 500 | 4328.87 | -34.62 | -0.79% |

| I:COMP | NASDAQ COMPOSITE INDEX | 13313.438007 | -224.50 | -1.66% |

RUSSIA’S ECONOMY GETS NAILED: WHAT’S BEEN DONE

We take a look at the sharp moves that rocked the commodity market this week.

US & Brent Crude Oil

U.S. crude jumped $24.09 per barrel, or 26.30% to $115.68. The largest one–week gain on record going back to April 1983 when price tracking began. It is now at the highest level since September 2008. Brent, the global benchmark, rose $23.99 per barrel, or 25.49% to $118.11 this week, also the largest on record since January 1991.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND L.P. | 79.43 | +4.86 | +6.52% |

| BNO | UNITED STS BRENT OIL FD LP UNIT | 32.77 | +2.08 | +6.78% |

Gold

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST – EUR ACC | 183.68 | +2.87 | +1.59% |

| NEM | NEWMONT CORP. | 74.32 | +3.63 | +5.14% |

| GOLD | BARRICK GOLD CORP. | 24.21 | +0.63 | +2.67% |

The yellow metal rose $78.60 per troy ounce, or 4.17% to $1,965.10 this week and is sitting at the highest level since September 2020. While gold is a safe haven in times of uncertainty, it is also a hedge to inflation which remains at record levels for consumer and producer prices.

INFLATION NATION: THESE STATES ARE PAYING THE HIGHEST PRICES

Last Sunday, Russia’s Central Bank noted it was “resuming” its gold buying. Shaokai Fan of the World Gold Council tells FOX Business Russia was an aggressive buyer of gold since the 2008 financial crisis but pared back in 2018.

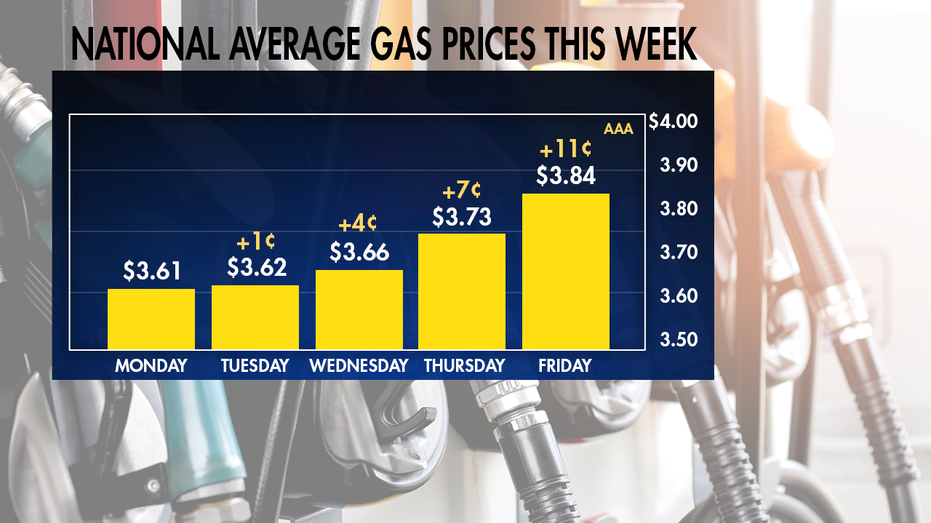

Gas Prices

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| UGA | UNITED STATES GASOLINE FUND LP PARTNERSHIP UNITS | 61.97 | +4.07 | +7.03% |

The national average for prices at the pump hit $3.87 jumping 11 cents from Thursday to Friday, the largest single-day increase since record-keeping began in 2000, according to AAA. Gas is now $1.08 higher than it was a year ago. Prices are inching closer to $4.00 per gallon, a level not seen since July 2008.

CLICK HERE TO READ MORE ON FOX BUSINESS

Soft Commodities – Corn, Wheat, Soybeans

Wheat futures traded above $11.45+ the highest since 2008, according to data from Trading Economics. Ukraine and Russia, combined, account for about 30% of global wheat exports. The conflict between the two countries could threaten long-term supplies. Corn traded above $7.50, the highest since May 2021, while soybeans hit a September 2012 high rising to $17.

WHEAT, CORN PRICES SURGE ON RUSSIA, UKRAINE CONFLICT

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WEAT | TEUCRIUM COMMODITY TRUST WHEAT FUND | 10.83 | -0.28 | -2.52% |

| CORN | TEUCRIUM COMMODITY TRUST CORN USD | 26.19 | +0.69 | +2.71% |

| SOYB | TEUCRIUM COMMODITY TRUST SOYABEAN USD | 27.06 | -0.18 | -0.66% |

Marc Smith of FOX Business Network contributed to this report.