LONDON, March 8 (Reuters) – From European banks to the Polish zloty, Moscow’s invasion of Ukraine has triggered massive price falls as well as a number of winners in assets that investors are racing to stock up on.

Commodity prices are soaring, defence stocks are benefiting from higher security spending pledges and emerging market investors are finding refuge in Latin America. With the world still awash with pandemic-era cheap cash, many assets are displaying eye-catching moves.

Below is a list of some of the winners. All price moves are since Feb. 24, the day of Russia’s invasion. Russia calls its actions a “special operation”. read more

Register now for FREE unlimited access to Reuters.com

COMMODITY SHARES

A 30% jump in oil prices since Moscow sent troops and tanks into Ukraine has turbocharged the shares of energy producers. The SPDR S&P Oil & Gas index has risen 14%, and some individual energy companies have gained far more.

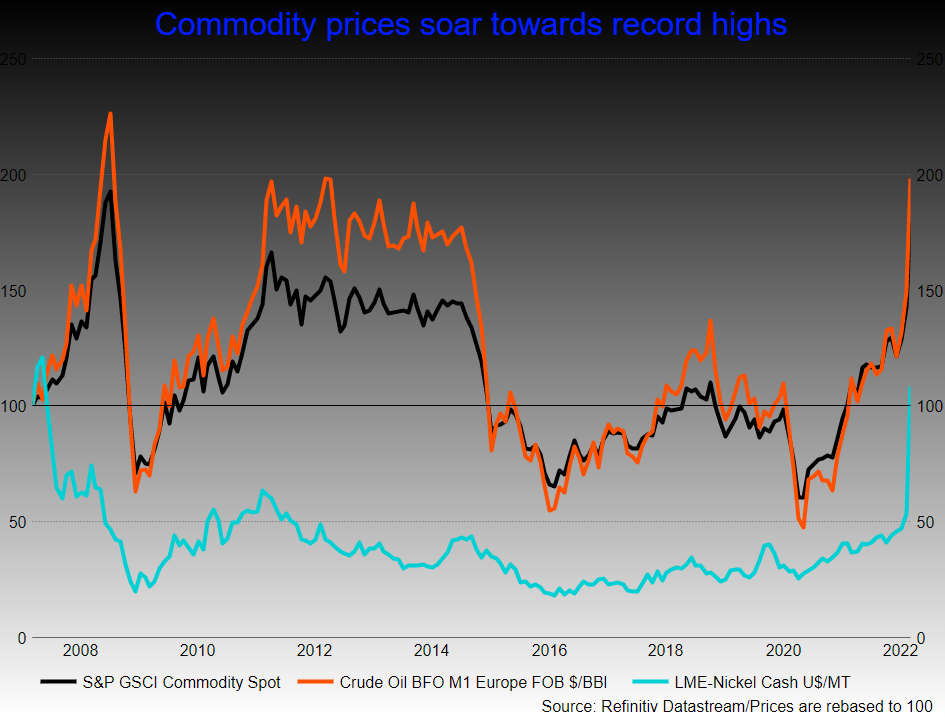

Russia’s large role in metals has driven even bigger jumps in other commodities.

It supplies about 10% of global nickel, and concern about Russian supplies and a short squeeze have sent London three-month nickel prices up four-fold since the invasion to a record above $100,000-a-tonne. That prompted the London Metal Exchange to halt trading on Tuesday. read more

Russia and Ukraine together account for about 29% of global wheat exports, and 19% of corn exports. Chicago wheat futures have jumped 40% to 14-year highs .

The S&P GSCI (.SPGSCI), a composite index of commodity sector returns, has risen 24% since Feb. 24 and stands 9% off record highs hit in 2008.

Commodity trading firms are booming too. Shares in Glencore (GLEN.L) are up 15%, and in Archer-Daniels-Midland 13% higher, while agribusiness Bunge has gained 11%.

COMMODITY CURRENCIES

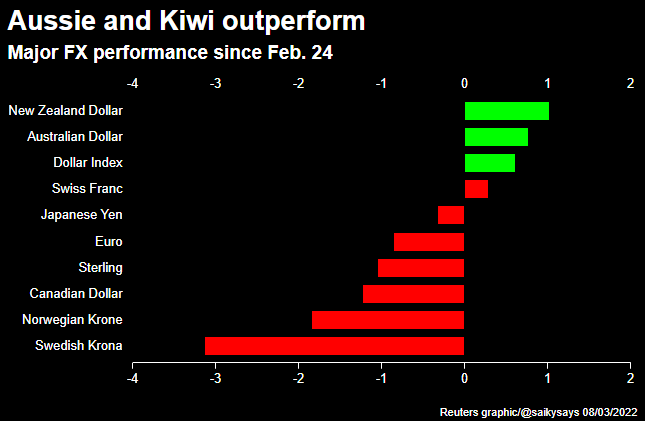

Currencies of commodity-exporting nations are outperforming.

The Australian and the New Zealand dollars are up nearly 1% since the invasion.

Those moves are striking because both currencies typically struggle when global market sentiment deteriorates and traders tend to scramble for safer assets, such as the Swiss franc and U.S. dollar, which are also strong.

The Norwegian crown , lifted by rising prices of Norway’s major export, oil, has risen 2.7% versus the euro.

Emerging market currencies tend to weaken in the face of a robust dollar, but those of resource-rich South Africa and Brazil have also performed well. ,

SUN AND WIND

The S&P Global Clean Energy Index (.SPGTCLEN) has gained 14.6% since the invasion on a bet Western countries will push harder to wean themselves off fossil fuels.

Wind energy suppliers Nordex (NDXG.DE) and Vestas Wind (VWS.CO) have risen around 50%. Citi reckons many European companies could see sharp revenue upgrades if Germany meets its wind energy expansion plans.

Invesco’s Solar ETF (TAN.P) has climbed 31%.

DEFENCE AND CYBER

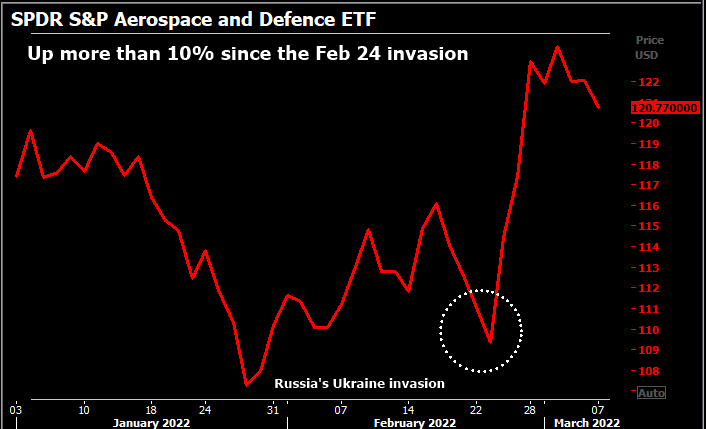

Manufacturers of jets, missiles and radar are big gainers after several European countries, notably Germany, pledged to spend more on defence. read more

Since Feb. 24, arms companies dominate the list of the top-performers in the MSCI World index, led by 60%-80% gains for German military sensor maker Hensoldt (HAGG.DE) and armoured vehicle manufacturer Rheinmetall .

U.S. firm Raytheon (RTX.N) – the manufacturer of Stinger missiles that Western allies are dispatching to Ukraine – is up around 15%.

The SPDR S&P Aerospace and Defence ETF (XAR.P) is 11% higher.

The Global X Cybersecurity ETF (BUG.O), which includes Check Point Software Technologies (CHKP.O) and Palo Alto Networks , has gained 9%.

“Cyber is one of our preferred long-term themes and that’s been borne out further with this crisis,” said Kiran Ganesh, at UBS Global Wealth Management.

He said many sustainably-focused investors usually exclude defence shares but “it’s a debate the industry needs to have… many would argue that security is a social good too.”

INTO LATAM

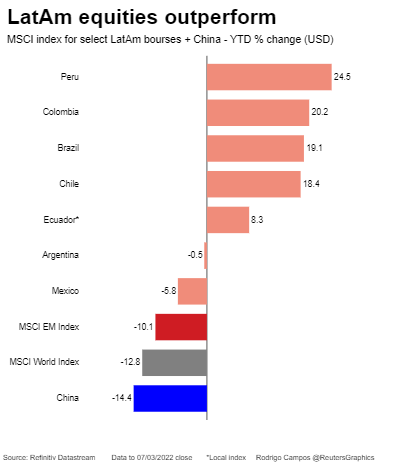

Investors are heading into Latin American markets, commodity-heavy and more insulated from the Russian fallout than other emerging markets.

Data from the Institute of International Finance shows Latin American markets received $8.7 billion of investment inflows and Asian emerging economies took in $6.8 billion over February.

The MSCI Latin America index (.MILA00000PUS) is higher versus pre-invasion levels, while its materials sub-index has jumped (.MILA0MT00PUS) 16% since Feb. 24.

“The commodity factor – whether agri commods or metals is supporting capital flows to LatAm,” said Jeremy Schwartz, chief investment officer at asset manager WisdomTree.

INFLATION PROTECTION

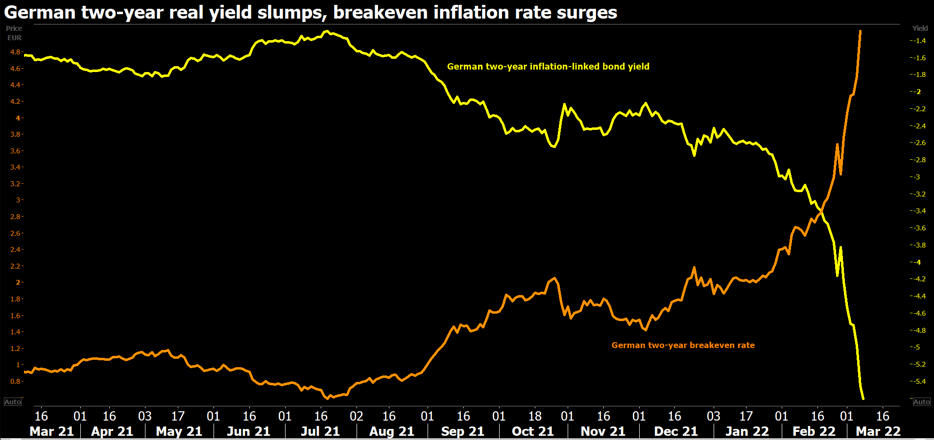

As the commodity surge threatens to lift inflation even further, inflation-linked bonds have proved a winner, especially in the euro zone where they have returned 7% since the invasion, BofA’s index shows.

The rally is most dramatic in short-dated ‘linkers’ with the yield on Germany’s two-year issue down 190 basis points since the invasion.

Register now for FREE unlimited access to Reuters.com

Additional reporting by Eileen Soreng and Yoruk Bahceli; editing by Barbara Lewis

Our Standards: The Thomson Reuters Trust Principles.