The boom is over. And there are broader effects.

By Wolf Richter for WOLF STREET.

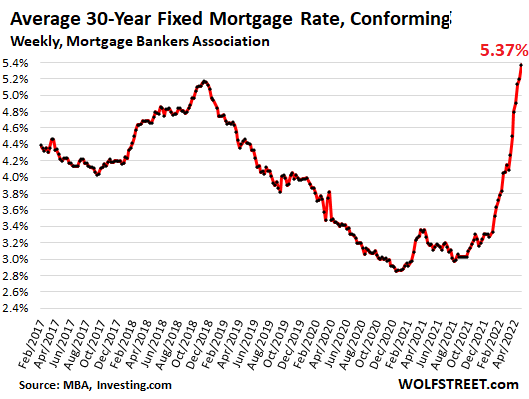

Spiking mortgage rates multiply the effects of exploding home prices on mortgage payments, and it has taken layer after layer of homebuyers out of the market for the past four months. And we can see that.

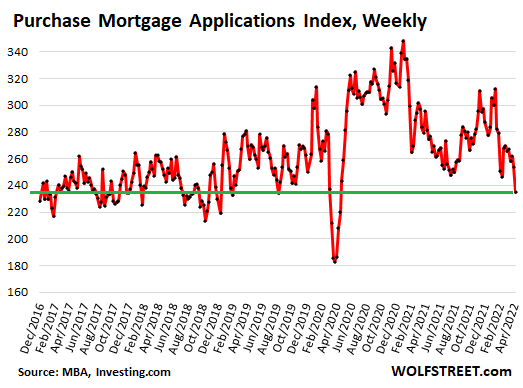

Mortgage applications to purchase a home fell further this week and were down 17% from a year ago, hitting the lowest level since May 2020, according to the Mortgage Bankers Association’s weekly Purchase Index today. The index is down over 30% from peak-demand in late 2020 and early 2021, which was then followed by the historic price spikes last year.

“The drop in purchase applications was evident across all loan types,” the MBA’s report said. “Prospective homebuyers have pulled back this spring, as they continue to face limited options of homes for sale along with higher costs from increasing mortgage rates and prices. The recent decrease in purchase applications is an indication of potential weakness in home sales in the coming months.”

The culprit of the plunge in volume: The toxic mix of exploding home prices and spiking mortgage rates. The average interest rate for 30-year fixed rate mortgages with 20% down and conforming to Fannie Mae and Freddie Mac limits, jumped to 5.37%, the highest since August 2009, according to the Mortgage Bankers Association’s weekly measure today.

What this means for homebuyers, in dollars.

The mortgage on a home purchased a year ago at the median price (per National Association of Realtors) of $326,300, and financed with 20% down over 30 years, at the average rate at the time of 3.17%, came with a payment of 1,320 per month.

The mortgage on a home purchased today at the median price of $375,300, and financed with 20% down, at 5.37% comes with a payment of $1,990.

So today’s buyer, already strung out by rampant inflation in everything else, would have to come up with an extra $670 a month – that represents a 50% jump in mortgage payments – to buy the same house.

Now figure this with homes in the more expensive areas of the country where the median price, after the ridiculous spikes of the past two years, runs $500,000 or $1 million or more. Homebuyers are facing massively higher mortgage payments in those markets.

The combination of spiking home prices and spiking mortgage rates has the effect that layers and layers of buyers are leaving the market. And we’re starting to see that in the decline of mortgage applications.

The Fed has caused this ridiculous housing bubble with its interest rate repression, including the massive purchases of mortgage-backed securities and Treasury securities.

And the Fed is now trying to undo some of it by pushing up long-term interest rates. It’s the Fed’s way – too little, too late – of trying to tamp down on the housing bubble and on the risks that the housing bubble, which is leveraged to the hilt, poses for the financial system.

What it means for consumer spending.

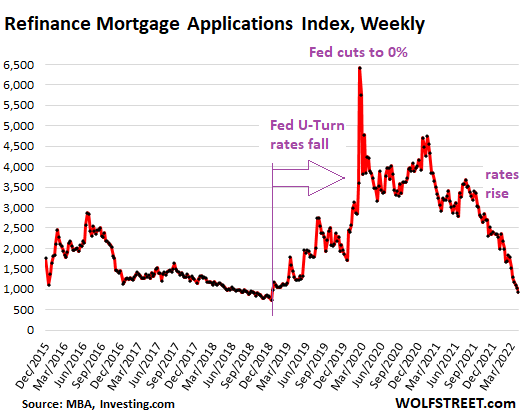

When mortgage rates fall, homeowners tend to refinance their higher-rate mortgages with lower-rate mortgages, either to lower their monthly payment, or draw cash out of the home, or both.

The wave of refis that started in early 2019, as the Fed did its infamous U-Turn and mortgage rates declined, became a tsunami starting in March 2020, as mortgage rates plunged to record lows over the next few months. Homeowners lowered their monthly payments, and spent the extra cash that the lower payments left them. Other homeowners extracted cash via cash-out refis and spent this money on cars and boats, and they paid down their credit cards to make room for future spending, and this money was recycled in various ways and boosted the economy. And some of it too was plowed into stocks and cryptos.

This effect ended months ago. By now, applications for refinance mortgages collapsed by 70% from a year ago, and by 85% from March 2020. Refis no longer support consumer spending, stocks, and cryptos.

What it means for the mortgage industry.

Mortgage bankers know that they’re in a highly cyclical business. Faced with rising mortgage rates, and collapsing demand for refis, and lower demand for purchase mortgages, the mortgage industry has started laying off people.

Add Wells Fargo, one of the largest mortgage lenders in the US, to the growing list of mortgage lenders that have reportedly started the layoffs late last year and so far this year, including most notoriously Softbank-backed mortgage “tech” startup Better.com, but also PennyMac Financial Services, Movement Mortgage, Winnpointe Corp., and others.

Wells Fargo confirmed the layoffs last Friday and a statement blamed the “cyclical changes in the broader home lending environment,” but didn’t disclose in which locations of its far-flung mortgage empire it would trim mortgage bankers, and how many.

So that boom is over. And the Fed has just now begun to push up interest rates, way too little and way too late, but it is finally plodding forward in order to deal with this rampant four-decade high inflation, after 13 years of rampant money-printing – an inflation of the magnitude the majority of Americans has never seen before.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()