CNBC’s Jim Cramer on Thursday highlighted two characteristics that are prevalent on Wall Street, suggesting investors can find success by owning companies that exhibit them both.

“It’s awfully hard to go wrong when you bet on companies with strong sales growth and rising gross margins,” the “Mad Money” host said.

Those financial attributes are currently being sought by institutional money managers who oversee large pools of capital, according to Cramer. “Everybody loves revenue growth,” but widening margins that demonstrate an ability to reach profitability matter now, too, he said.

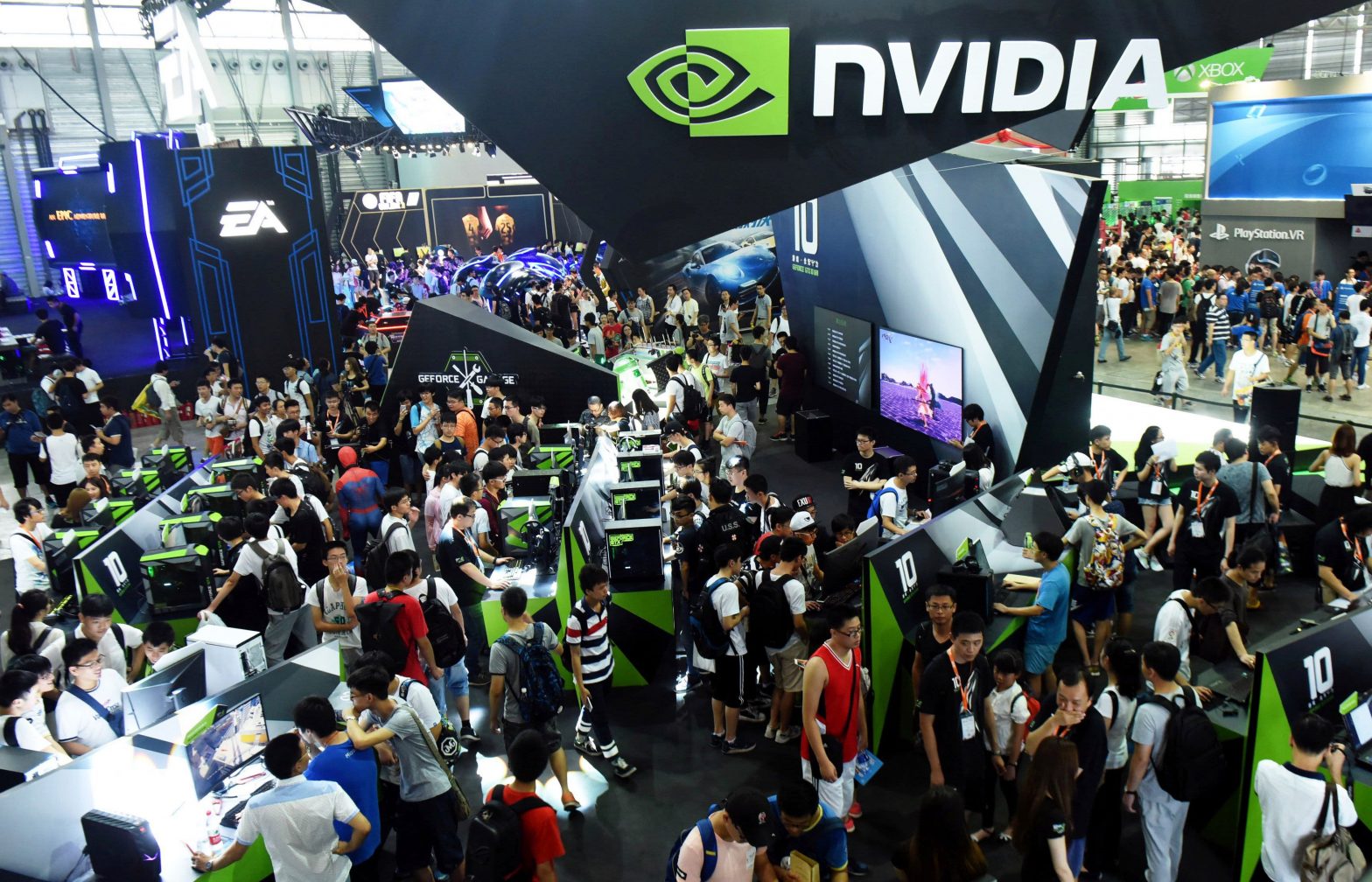

For example, Cramer said this line of thinking can explain why Nvidia has been on such a tear recently, with shares up 42.54% over the past month. The semiconductor titan “has the fastest revenue growth and some of the most outstanding gross margins I have seen of any large company,” he said.

The retail industry further illustrates the power of rising sales and widening margins, Cramer said.

Walmart decided to absorb cost increases, leading to tightening margins, and the retailer’s stock struggled Tuesday after it reported earnings, Cramer said.

By contrast, he said Home Depot and Lowe’s were embraced by investors after the home improvement stores reported earnings this week. “They can do no wrong because they’re passing on rising costs to the public, and the public has no choice, … because these two chains have single-handedly wiped out the competition already,” he said.

While Cramer acknowledged companies can improve margins in other ways than just passing on rising materials costs, he said that particular strategy is what’s being rewarded by the market right now. He said more than anything, Wall Street wants “companies that can make fortunes because they have very little competition, they have tremendous pricing power, and they can keep raising prices on you at will,” he said.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market. Disclosure: Cramer’s charitable trust owns shares of Walmart and Nvidia.