The stock market, shocked by the Federal Reserve’s policy changes to fight inflation, has been gored this year, with growth and technology companies bearing the brunt of the biggest declines. Dividend stocks, in contrast, have actually risen.

Below is a screen of the components of the S&P 500 High Yield Index expected to raise their quarterly dividend payouts the most over the next two years. The current dividend yields aren’t necessarily very high. But a rapid increase in payouts may bode well for overall performance as the increases imply healthy cash-flow trends.

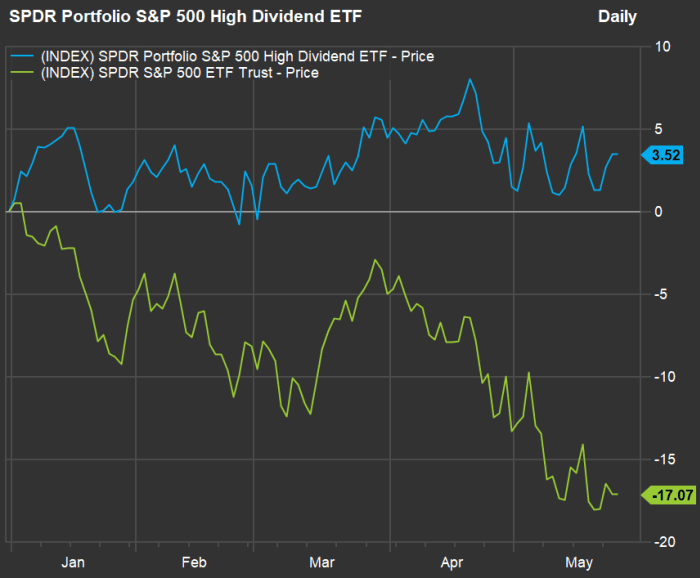

First, check out this comparison of total returns (with dividends reinvested) for the the SPDR Portfolio S&P 500 High Dividend ETF

SPYD

and the SPDR S&P 500 ETF

SPY

:

FactSet

That performance for the high-dividend group — a total return of 3.5% this year through May 24 — has been nothing short of breathtaking when you consider that the S&P 500 has dropped 17.1%.

Components of the High Yield Index

Starting with the full S&P 500

SPX,

S&P Dow Jones Indices narrows the list to 80 stocks with the highest indicated dividend yields for the next 12 months. The High Yield Index is rebalanced semi-annually.

Click here for S&P Dow Jones Indices’ description of the S&P 500 High Yield Index, then click on the fact sheet and methodology for more information.

Screening for dividend stocks

The components of the S&P 500 High Yield Index have dividend yields ranging from 1.98% (Baker Hughes Co.

BKR

) to 8.42% (Lumen Technologies Inc.

LUMN.

(Lumen had been known as CenturyLink until it was renamed in September 2020. The company cut its dividend payout by more than 50% in February 2019, showing that investors need to dig in with further research, especially if a stock has a very high current yield).

In comparison, the S&P 500 has a weighted dividend yield of 1.63%, according to FactSet.

Highest expected dividend increases

Here are the 15 companies in the S&P 500 High Yield Index expected to increase their annual dividend payouts the most through 2024, based on consensus estimates among analysts polled by FactSet:

| Company | Ticker | Current dividend yield | Current annual dividend rate | Estimated dividend – 2023 | Estimated dividend – 2024 | Two-year estimated dividend increase |

| EOG Resources Inc. | EOG | 2.32% | $3.00 | $3.09 | $5.72 | 47.6% |

| PPL Corp. | PPL | 2.68% | $0.80 | $1.03 | $1.10 | 27.0% |

| M&T Bank Corp. | MTB | 2.84% | $4.80 | $5.34 | $6.27 | 23.5% |

| Regions Financial Corp. | RF | 3.33% | $0.68 | $0.79 | $0.87 | 22.3% |

| Omnicom Group Inc. | OMC | 4.03% | $2.80 | $3.18 | $3.51 | 20.3% |

| Baker Hughes Company Class A | BKR | 1.98% | $0.72 | $0.78 | $0.89 | 18.9% |

| Amgen Inc. | AMGN | 3.08% | $7.76 | $8.32 | $9.52 | 18.5% |

| PrInc.ipal Financial Group Inc. | PFG | 3.64% | $2.56 | $2.82 | $3.10 | 17.5% |

| Citizens Financial Group Inc. | CFG | 4.03% | $1.56 | $1.72 | $1.88 | 17.0% |

| Welltower Inc. | WELL | 2.76% | $2.44 | $2.64 | $2.92 | 16.4% |

| Viatris Inc. | VTRS | 4.16% | $0.48 | $0.50 | $0.57 | 15.8% |

| Ventas Inc. | VTR | 3.20% | $1.80 | $1.98 | $2.13 | 15.5% |

| Huntington Bancshares Inc. | HBAN | 4.62% | $0.62 | $0.67 | $0.73 | 15.4% |

| Altria Group Inc. | MO | 6.80% | $3.60 | $3.98 | $4.25 | 15.3% |

| Citigroup Inc. | C | 3.87% | $2.04 | $2.20 | $2.40 | 15.1% |

| Source: FactSet | ||||||

Click on the tickers for more about each company.

Read Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

A look back over the past five years shows that three of the companies, above, have cut their dividends:

-

PPL Corp.

PPL

cut its payout by 52% in February. -

Welltower Inc.

WELL

lowered its dividend by 30% in August 2020. -

Ventas Inc.

VTR

reduced its dividend by 43% in August 2020.

Highest current dividend yields

These 15 companies in the S&P High Yield Dividend Index have the highest dividend yields. From the consensus estimates for payouts through 2024, two are expected to cut their dividends:

| Company | Ticker | Current dividend yield | Current annual dividend rate | Estimated dividend – 2023 | Estimated dividend – 2024 | Two-year estimated dividend increase |

| Lumen Technologies, Inc. | LUMN | 8.42% | $1.00 | $0.88 | $0.91 | -10.3% |

| Altria Group Inc. | MO | 6.80% | $3.60 | $3.98 | $4.25 | 15.3% |

| Simon Property Group Inc. | SPG | 6.31% | $6.80 | $7.14 | $7.48 | 9.0% |

| Vornado Realty Trust | VNO | 6.25% | $2.12 | $2.27 | $2.30 | 8.0% |

| ONEOK Inc. | OKE | 5.87% | $3.74 | $3.82 | $3.94 | 5.0% |

| Kinder Morgan Inc. Class P | KMI | 5.80% | $1.11 | $1.15 | $1.20 | 7.2% |

| AT&T Inc. | T-US | 5.25% | $1.11 | $1.11 | $1.07 | -3.5% |

| Verizon Communications Inc. | VZ | 5.05% | $2.56 | $2.64 | $2.70 | 5.0% |

| International Business Machines Corp. | IBM | 4.93% | $6.60 | $7.03 | $7.13 | 7.5% |

| Newell Brands Inc. | NWL | 4.89% | $0.92 | $0.92 | $0.93 | 0.7% |

| Iron Mountain Inc. | IRM | 4.82% | $2.47 | $2.55 | $2.64 | 6.1% |

| Prudential Financial Inc. | PRU | 4.76% | $4.80 | $5.10 | $5.45 | 11.9% |

| Williams Cos. Inc. | WMB | 4.69% | $1.70 | $1.78 | $1.86 | 8.7% |

| Philip Morris International Inc. | PM | 4.69% | $5.00 | $5.26 | $5.45 | 8.2% |

| Huntington Bancshares Inc. | HBAN | 4.62% | $0.62 | $0.67 | $0.73 | 15.4% |

| Source: MarketWatch | ||||||

So two of the highest-yielding stocks in the S&P 500 High Yield Index are expected to lower payouts. Over the past five years, these companies have lowered their dividends:

- Lumen Technologies, under its previous name, CenturyLink, cut its dividend by 54% in February 2019.

-

Simon Property Group Inc.

SPG

lowered its dividend by 38% in June 2020. -

Vornado Realty Trust

VNO

most recently cut its payout in June 2020, by 19%. -

AT&T Inc.

T

cut its dividend by 47% in March, in connection with its spinoff of WarnerMedia.

Don’t miss: Which of Buffett’s bank stocks might make you the most money?