Lawmakers, local reporters and journalism advocates are sounding the alarm over a takeover attempt of local newspaper group Lee Enterprises by Alden Global Capital, a hedge fund known for cutting journalists at local papers to maximize profits.

Why it matters: Roughly half of America’s daily newspapers are already controlled by investment groups. Alden’s takeover would make it a clear majority.

The big picture: Alden already owns hundreds of papers through its majority ownership of MNG Enterprises, known commonly as Digital First Media.

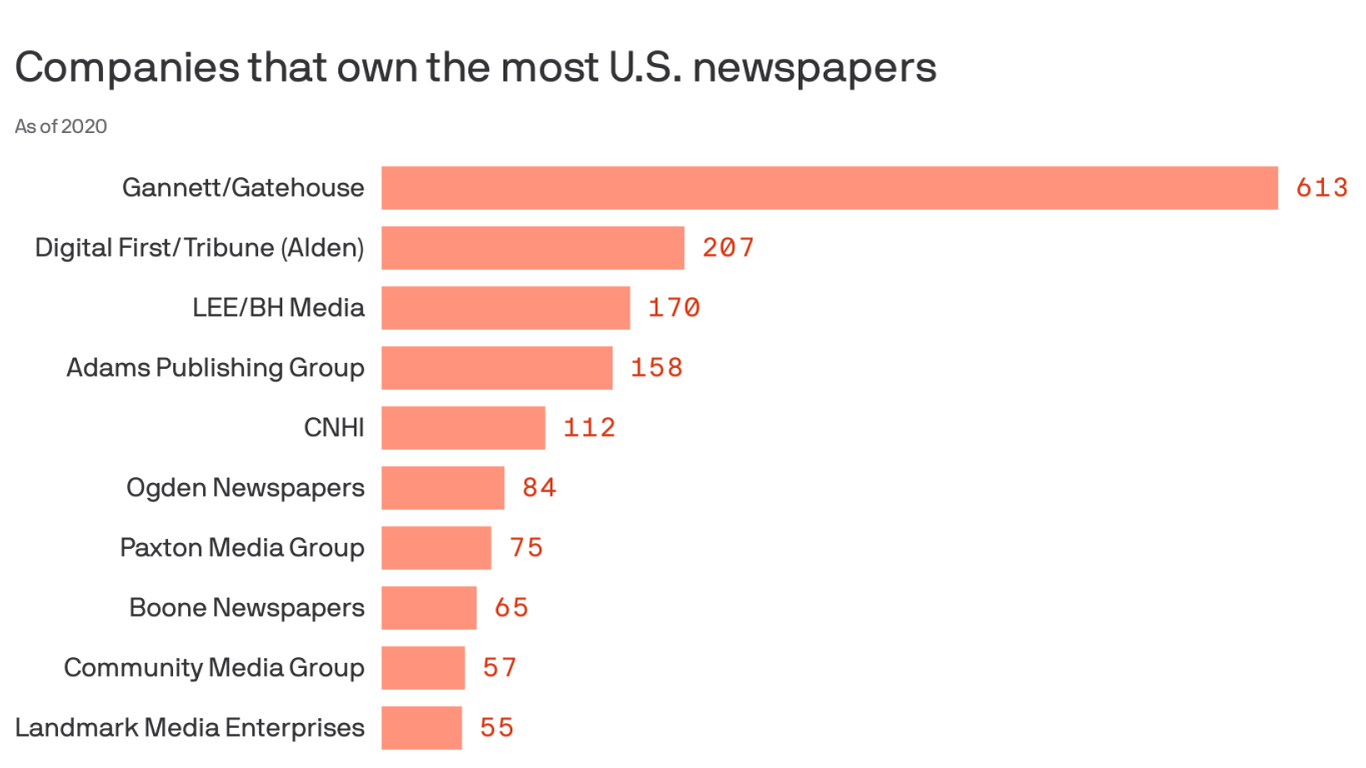

- It acquired the remaining stake of Tribune earlier this year, making it the second-largest newspaper owner in the country.

- Alden acquired a 6% stake in Lee Enterprises via MNG Enterprises in early 2020, when billionaire Warren Buffett sold his Berkshire Hathaway newspaper operations to Lee Enterprises for $140 million.

- Lee Enterprises is home to many storied local newspapers, including The Omaha World-Herald, The Richmond Times-Dispatch, and Winston-Salem Journal.

- Purchasing Lee Enterprises would essentially create a local news duopoly between Alden and Gannett/Gatehouse, which merged in 2019.

Details: On Monday, Alden Global Capital announced an offer to acquire Lee Enterprises for $24 per share, a 30% premium on Lee’s share price at market close on Friday.

- Investors seemed thrilled. Lee’s stock jumped 26% Monday on the news. The deal values Lee Enterprises at about $141 million.

- Local reporters were clearly rattled. “Gut-wrenching scenario for Nebraska newspapers and anyone who cares about preserving robust local news,” tweeted Sara Gentzler, a state government reporter for the Omaha World-Herald.

Policymakers also expressed concern, but it doesn’t seem like there’s any real regulatory threat standing in Alden’s way.

- “It is deeply concerning that hedge funds continue to gobble up local news companies, gut newsrooms and then rake in short-term profits while starving communities of a vital resource,” said Sen. Ron Wyden (D-Ore).

- An antitrust expert told Axios that it appeared unlikely the deal would face major regulatory hurdles, given that the newspapers Alden is buying generally don’t compete head-to-head with its current properties.

Yes, but: Some experts argue that the Biden administration’s Department of Justice should take a different approach when evaluating the harm of this merger and other local media consolidation deals.

- The DOJ typically evaluates mergers based on whether they will lift prices or cause consumer harm. Steven Waldman, president and co-founder of Report for America, argues the DOJ should consider whether deals like this could possibly cause harm to a community.

- “The traditional approach to antitrust is not going to help local communities and the local news crisis,” Waldman said. “It has to be looked at through a revised approach to antitrust that looks at other harms.”

What to watch: Wyden and other Democratic senators introduced a bill earlier this year to help fund local news through government tax credits.

- While these efforts are incremental, they are meant to offer relief to local newspapers.

- Wyden said he supports the bill “so that the local newspapers that remain won’t feel pressured to sell to these corporate raiders.”

Be smart: Local news used to be mostly run by family businesses. But they’ve increasingly become attractive to investment firms like Alden, which focus on identifying industries and companies in terminal decline and consolidate them to squeeze out more profits.

- Local news, both in print and broadcast, is a perfect target for investment firms using this strategy. Newspapers and linear television are being replaced by digital alternatives, but still have sizable ad businesses for now.

- Alden is essentially betting that those industries will die slower than people expect.