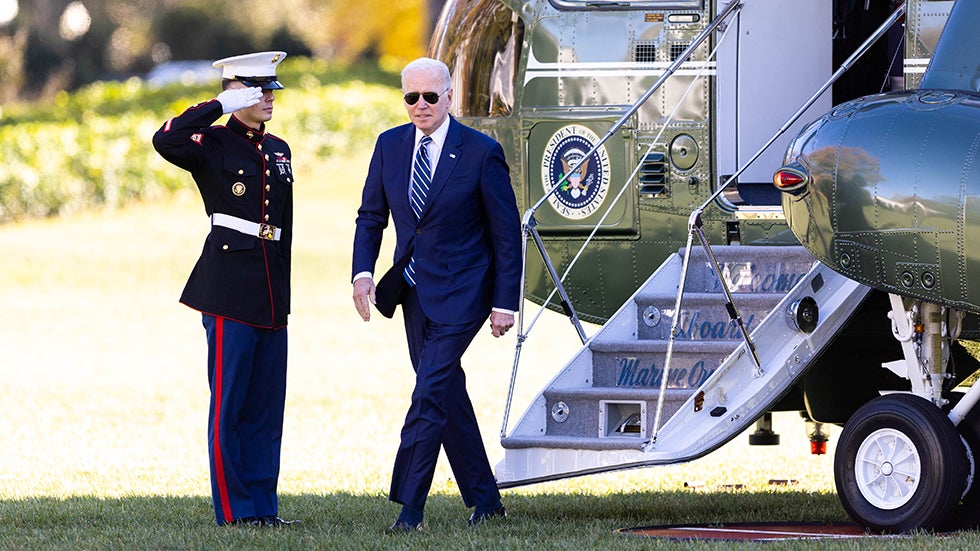

President Biden Joe BidenSouth Africa health minister calls travel bans over new COVID variant ‘unjustified’ Biden attends tree lighting ceremony after day out in Nantucket Senior US diplomat visiting Southeast Asia to ‘reaffirm’ relations MORE is under fresh pressure from climate activists after rejecting their push to replace Federal Reserve Chair Jerome Powell.

Joe BidenSouth Africa health minister calls travel bans over new COVID variant ‘unjustified’ Biden attends tree lighting ceremony after day out in Nantucket Senior US diplomat visiting Southeast Asia to ‘reaffirm’ relations MORE is under fresh pressure from climate activists after rejecting their push to replace Federal Reserve Chair Jerome Powell.

Biden announced Monday he would renominate Powell, a Republican first appointed to the role by former President Trump Donald TrumpJan. 6 panel faces double-edged sword with Alex Jones, Roger Stone Trump goes after Woodward, Costa over China Republicans seem set to win the midterms — unless they defeat themselves MORE, to another four-year term leading the Fed board despite intense pressure from the left. He also tapped Fed Governor Lael Brainard, the only Democrat on the bank’s board, to serve as vice chair.

Donald TrumpJan. 6 panel faces double-edged sword with Alex Jones, Roger Stone Trump goes after Woodward, Costa over China Republicans seem set to win the midterms — unless they defeat themselves MORE, to another four-year term leading the Fed board despite intense pressure from the left. He also tapped Fed Governor Lael Brainard, the only Democrat on the bank’s board, to serve as vice chair.

Powell is generally aligned with Biden on the best way to foster a full recovery from the pandemic-driven recession and has key allies in both parties. But his support for looser financial regulations and refusal to turn the screws on the fossil fuel industry turned many progressive lawmakers and climate groups against his renomination.

Spurned by Powell’s reappointment, that broad progressive coalition is now pushing Biden to nominate a Fed vice chair of supervision who will fight the risk a changing climate poses to the financial sector and push banks away from financing projects that could exacerbate the problem.

The role “is extremely important, possibly even more important than the chair” when it comes to the kinds of actions that can help insulate the financial system from the risk of a changing climate and energy sector, said Ilmi Granoff of the advocacy group ClimateWorks.

That’s particularly true for someone working under Powell, who has historically “deferred” to his vice chair for supervision, Granoff said. “You can ask whether it should be that way, but if things continue as they have historically, I’d want Biden’s vice chair to be someone who is serious about the supervision of climate related financial risk — and prepared to act.”

The Fed vice chair of supervision is the board’s point person for regulation, bank oversight and financial stability — in charge of everything from ordering stress tests and scenario analysis to setting bank capital requirements. The position was created through the 2010 Dodd-Frank Wall Street reform law but sat vacant until Trump appointed Randal Quarles to be the Fed’s first vice chair of supervision in 2017.

Quarles’s term as vice chair of supervision ended in October, and he is set to leave the Fed next month, giving Biden another spot to fill on the seven-person board of governors. Whoever Biden nominates will likely play a crucial role in driving the Fed’s regulatory agenda — even with Powell in charge.

During Quarles’s term, he and Powell presided over a deregulatory push. They loosened and streamlined several Dodd-Frank rules over the objections of Brainard, including cutting capital requirements and deferring stress tests.

“When Vice Chair Quarles was confirmed to his position, banking lobbyists cheered,” Sen. Sherrod Brown Sherrod Campbell BrownFive Senate Democrats reportedly opposed to Biden banking nominee Senate Democrats call on Biden to push for COVID-19 vaccine patent waivers at WTO Biden sidesteps Fed fight, disappointing progressive allies MORE (D-Ohio) wrote Powell in October.

Sherrod Campbell BrownFive Senate Democrats reportedly opposed to Biden banking nominee Senate Democrats call on Biden to push for COVID-19 vaccine patent waivers at WTO Biden sidesteps Fed fight, disappointing progressive allies MORE (D-Ohio) wrote Powell in October.

While Powell may have found it easier to defer to a vice chair aligned with his view on regulations, he said in September that he will let whoever Biden nominates to replace Quarles lead the way.

“It’s a specific grant of authority,” Powell told reporters during a September press conference, referring to Dodd-Frank’s creation of the supervision vice chairmanship.

“I respect that that’s the person who will set the regulatory agenda going forward, and I would accept that,” Powell continued, adding that it’s “fully appropriate” for a new supervision chief to make changes.

Major decisions such as the approval of new rules and enforcement actions against banks must still be approved by a majority on the Fed board. But a new more hawkish supervision chief could accelerate the Fed’s efforts toward assessing and limiting financial risks from the climate system.

With Powell staying on as chair, progressives want a vice president for supervision with regulatory experience who is “interested in looking at bank concentration and generally addressing speculation and risky actions by the finance sector,” said Alex Martin of Americans for Financial Reform — particularly those caused by climate. The recent Financial Stability Oversight Council report, to which the Fed is a signatory, labeled climate change an “emerging threat to the stability of the U.S. financial system” and urged policymakers to consider regulations that could slow the warming of planet.

One name progressives kept returning to was Sarah Bloom Raskin, a former board member and deputy Treasury secretary under Obama who has been outspoken about the need to prepare the financial system for climate shocks before they become overwhelming — a process already well underway at the central banks in Europe and the United Kingdom.

Granoff of Climate Works compared the vice chair for supervision to the steersman of “a very big ship,” whose priorities help get the country’s thousands of banks moving in a coherent direction.

By calling for climate stress tests and scenario analysis, Granoff added, someone such as Raskin can also uncover the sorts of climate-linked financial risks that the Fed and banks themselves are well prepared to mitigate, but someone has “to set the supervisory agenda, to get technocratic machinery in place to look at those risks and elicit the information.”

Even so, Biden could face serious challenges getting a bona fide climate hawk through the Senate confirmation process in a chamber evenly divided between Democrats and Republicans.

Republican lawmakers have blasted the Fed for its initial steps to study climate-related financial risks and fiercely object to stress testing banks for climate exposure.

Republicans have also warned the Fed against any regulations or efforts that would steer financing away from the fossil fuel industry and toward cleaner sources of energy — another area that would fall under the supervision chief’s purview — even as they successfully pushed the Fed to bend the rules of a key pandemic emergency aid bond program to admit oil and gas companies, ending what had been a period of long-term decline for the sector.

Conservatives take a dimmer view of providing similar support to renewables, and any Fed nominee pledging to take aggressive action against climate risk in the financial sector will likely need unanimous support from Democrats to overcome the universal opposition of Republicans — a daunting challenge given Sen. Joe Manchin Joe ManchinWith extreme gerrymanders locking in, Biden needs to make democracy preservation job one Five reasons for Biden, GOP to be thankful this season White House looks to rein in gas prices ahead of busy travel season MORE‘s (D-W.Va.) opposition to many far-reaching climate policies.

Joe ManchinWith extreme gerrymanders locking in, Biden needs to make democracy preservation job one Five reasons for Biden, GOP to be thankful this season White House looks to rein in gas prices ahead of busy travel season MORE‘s (D-W.Va.) opposition to many far-reaching climate policies.

An ideologically broad range Fed officials, including Powell, also ruled out any actions that could be perceived as the bank picking winners and losers.

Mary Daly, president of the Federal Reserve Bank of San Francisco, said during a virtual interview last month that the central bank cannot afford to risk its independence by being “part of the allocative mechanism in society,” or determining how and on what projects resources are used.

“If congressional leaders decide that the Fed should have more of these responsibilities, we all stand ready to do what we’re supposed to do. But stepping back as a person who’s worked for the Fed a long time,” she continued, “I see the real benefits of maintaining an independent central bank and having us not pick winners and losers in any of the discussions that emerge in our society.”

But advocates for a more hawkish Fed point to Europe and the United Kingdom for a vision of what nonpartisan financial reform around climate can look like.

“We want the Fed to do what the Europeans are already doing,” said Yevgeny Shrago of consumer advocacy group Public Citizen. “Our view is that — as in the 2008 housing crisis — if banks are financing climate change, it will come around and destroy the financial system, so the Fed needs to encourage banks to invest in a way that is responsible and will not cause significant destruction.”