Today we saw the launch of the new Capital One Venture X Rewards Credit Card, which is Capital One’s new premium credit card. I just applied for the card this morning and got instantly approved. I wanted to share my experience, and I’m hoping OMAAT readers can share their application experience, so we can get as many data points as possible.

The Capital One Venture X is worth applying for, plain and simple. Not only does the card have a massive welcome bonus of 100K miles plus a $200 vacation rental credit. Beyond that, in the long run the $395 annual fee card offers a $300 annual travel credit, 10K anniversary bonus miles, Capital One Lounge access, a Priority Pass membership, awesome authorized user perks, and more.

In this post I wanted to go over everything you need to know about getting approved for the Capital One Venture X.

Capital One Venture X eligibility requirements

I know for some people in the travel space, the Capital One Venture X may be the first Capital One product that they’re applying for. There are a lot of rumors about Capital One’s application restrictions, so let’s go over the basic eligibility requirements you need to be aware of.

What are Capital One’s approval restrictions?

While Capital One doesn’t officially publish these restrictions, anecdotally speaking there are a couple of things to be aware of when applying for Capital One cards:

- You can typically only be approved for one Capital One card every six months

- You can typically have at most two Capital One personal credit cards at a time, excluding co-brand cards

For most people those shouldn’t be major restrictions, but they’re worth being aware of.

What credit score do you need to be approved for the Venture X?

There’s not a consistent rule as to what credit score you need to be approved for the Capital One Venture X, though I’d recommend having a credit score in the “good” to “excellent” category if you’re going to apply for this card.

Personally, I probably wouldn’t apply if my credit score were under 700, and ideally, I’d hope to have a credit score of 740 or higher. That being said, some people with scores lower than that will likely be approved, and some people with scores higher than that will likely be rejected. There are lots of factors that go into approval — your income, your credit history, how much credit Capital One has already extended you, etc.

Can you get the Venture X if you have the Venture?

Yep, you sure can. You are eligible for the Capital One Venture X, including the welcome bonus, even if you have another version of the Capital One Venture. Just apply for the card outright, and hopefully you’ll be approved. While it may also be possible to product change, note that you wouldn’t be eligible for the new cardmember bonus then.

Does Capital One deny people with excellent credit?

There’s a rumor out there that Capital One denies many people with excellent credit, because Capital One allegedly wants people who carry a balance and finance charges (after all, that’s one way that credit card issuers make money).

I can’t personally speak to that. I’ve definitely seen some data points about people with excellent credit being denied for Capital One cards, though both of the Capital One cards I’ve applied for have been instant approvals (and I have excellent credit and don’t carry a balance).

Anecdotally, I’ve heard from quite a few readers with excellent credit this morning who received instant approval. Given that this is an ultra-premium credit card, maybe the card is actually easier to get approved for in some ways? I don’t know, all I can do is share my experience.

Does Capital One still pull from all three credit bureaus?

Capital One is one of the only card issuers that pulls your credit from all three credit bureaus when you apply for a card. That’s still the case, though personally I don’t view this as a big deal at all. Your score will typically be dinged a few points temporarily when you apply for a card, and it really shouldn’t matter with how many bureaus your credit is pulled. At least that’s my take — this restriction has never really bothered me, though I know others feel differently.

Which is the minimum credit line for the Venture X?

The Venture X is a Visa Infinite Card, and Visa Infinite products have a minimum credit line of $10,000.

What happens if you get denied for the Venture X?

If you’re not sure if you’ll be approved for the Venture X, should you be worried about getting denied? Generally speaking, getting denied for a credit card isn’t a big deal at all. You can always apply again in the future, and it’s not like a denial is reported negatively on your credit score. Rather the inquiry as such will show on your credit report (and could temporarily lower your credit score a few points), but that’s about it.

Capital One Venture X application guide

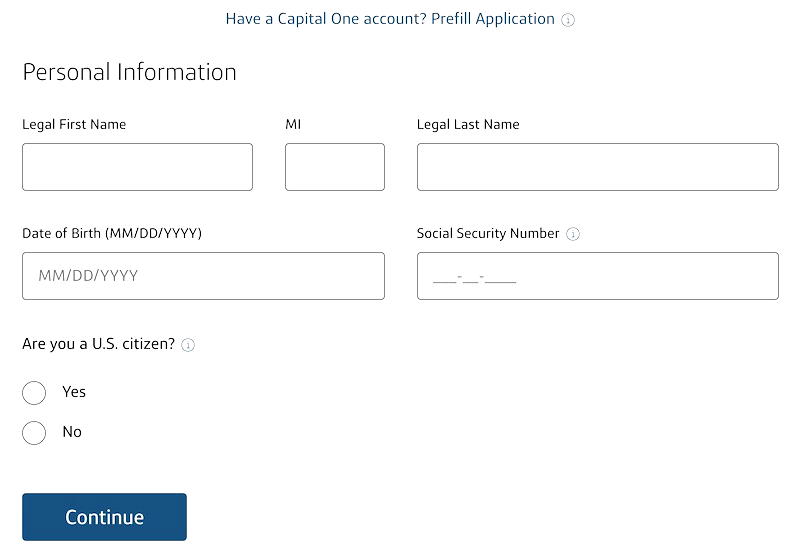

I applied this morning for the Capital One Venture X, and wanted to share my experience with the application process. The application took all of two minutes to fill out. The first page asked for my name, date of birth, and social security number.

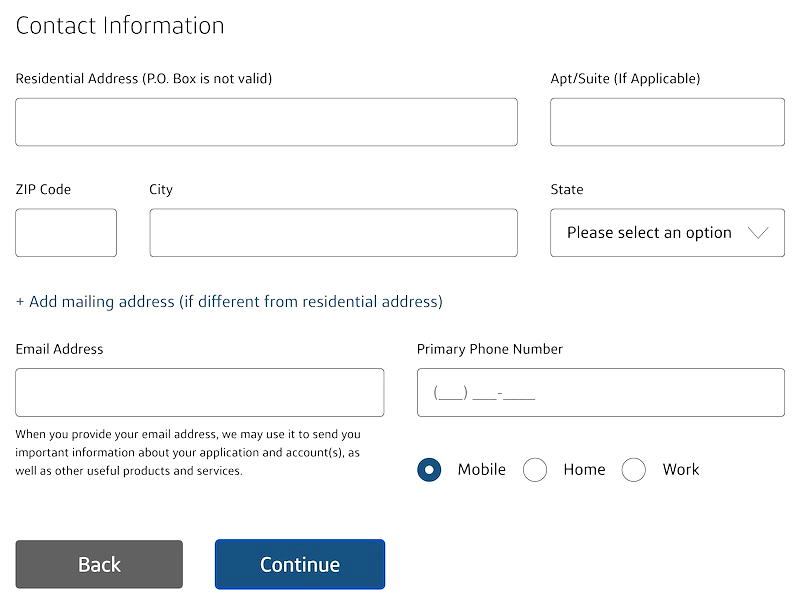

The next page asked for my mailing address details, plus my email address and phone number.

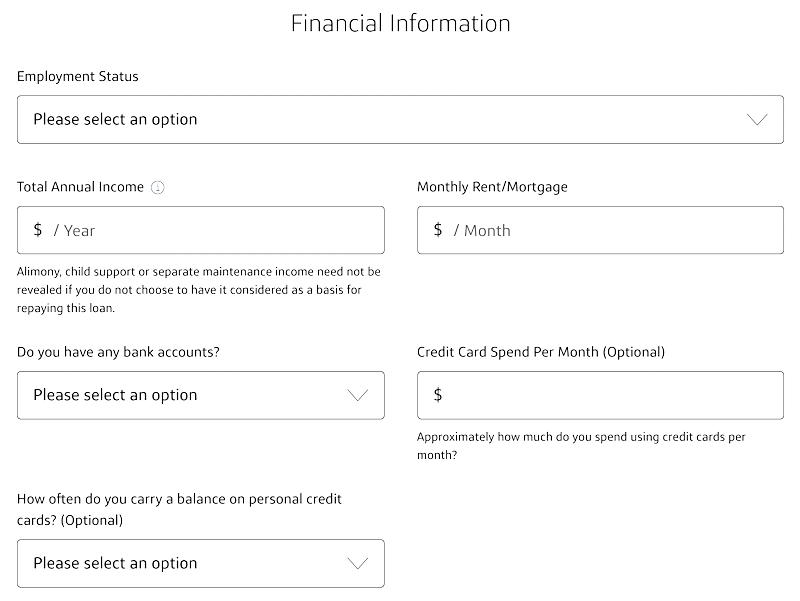

The next page asked for financial information, including employment status, income, my monthly rent or mortgage, basic information about what kind of accounts I have, how much I spend on credit cards, and if I typically carry a balance (those last two are optional, and I left them blank).

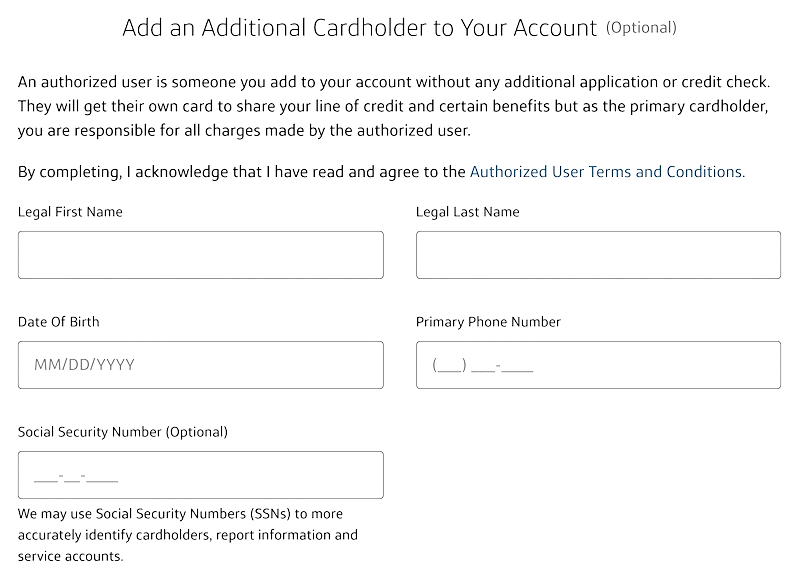

I was then asked if I wanted to add additional cardmembers in the event that I’m approved.

At that point I was asked to confirm that all the information I provided was accurate, and then my application was submitted — I was instantly approved, with a huge credit line no less. Ford had the same experience, and also god an instant approval. Woot!

Bottom line

The Capital One Venture X is accepting applications as of today, and I’m thrilled that I was instantly approved. This is simply a phenomenal new card, both in terms of the welcome bonus, as well as in terms of the ongoing perks. The card offers annual perks that more than justify the annual fee (a $300 travel credit plus 10K bonus miles), and on top of that the card offers an awesome lounge access perk.

More data points would be useful, so if you applied for the Venture X, what was your experience like? Instant approval, denial, or what? The more info OMAAT readers can share, the better!