(Kitco News) – Sentiment in the gold market has turned significantly bullish as the precious metal sees its best weekly gain in six months.

This week gold prices broke their current downtrend. They pushed to a five-month high as inflation fears flooded back into the market after the U.S. Consumer Price Index showed an annual rise of 6.2%, the highest reading in more than 30 years.

“A lot of investors have been waiting for this. Gold did exactly what it was supposed to do, which is protect investors from rising inflation,” said Philip Streible, chief market strategist at Blue Line Futures.

December gold prices last traded at $1,865.80 an ounce, up nearly 2.7% for the week.

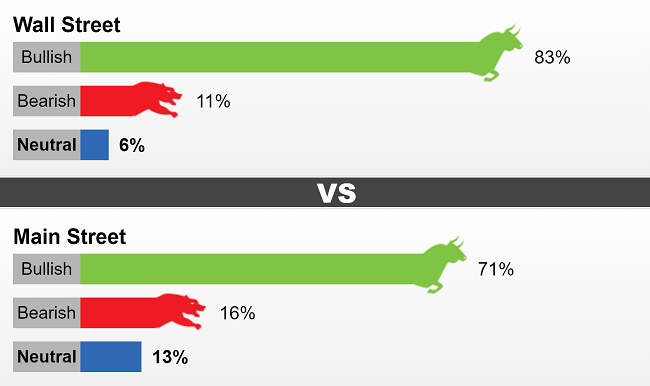

This week 18 Wall Street analysts participated in Kitco News’ gold survey. Among the participants, 15 analysts, or 83%, called for gold prices to rise next week. At the same time, two analysts, or 11%, were bearish on gold in the near term, and one analyst or 6% was neutral on prices.

Meanwhile, A total of 1,018 votes were cast in online Main Street polls. Of these, 722 respondents, or 71%, looked for gold to rise next week. Another 165, or 16%, said lower, while 131 voters, or 13%, were neutral.

Sentiment among retail investors is at its highest level since early May, and participation in the Kitco surveys is highest in a month.

Not only is gold finding renewed interest as inflation continues to rise, but some analysts have said that the growing fear that the Fed is losing control will continue to support prices.

“The inflation genie is out of the bottle and it won’t be going back in for some time. As generalist investors turn to gold to take even a small allocation, the move could be dramatic,” said Adrian Day, president of Adrian Day Asset Management.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said that he expects gold prices to continue to move higher as the break above $1,835 was a significant move. He added that a rally in silver and platinum should also solidify gold’s new uptrend.

“The prospect of increasing inflation, which ignited this week’s precious metal rally, may continue into next week with Canada and the U.K. reporting inflation numbers,” he said.

Jim Wyckoff, senior technical analyst at Kitco.com, said that he is also bullish on gold. In a research note, he said that gold is in a five-week uptrend. The next resistance target is $1,900 an ounce.

Adam Button, chief currency strategist at Forexlive.com, said that he expects gold prices to move higher as sentiment in the futures market improves after this breakout.

“Sentiment is still as bad as I’ve ever seen it, but that’s the best starting point. Positive price action can quickly turn bears into bulls,” he said.

However, not all analysts are bullish on gold in the near term. Ole Hansen said that he could see prices pull back to $1,830 an ounce before investors take another major run at $1,900.

Marc Chandler, managing director at Bannockburn Global Forex, said that while gold has made an impressive run. But, he is not convinced that the precious metal can withstand headwinds from rising bond yields and a stronger U.S. dollar.

“It could be the drivers are changing, but I am skeptical. A stronger dollar and higher yields are the traditional banes of the gold bulls. The U.S. economy is accelerating after a soft 2% annualized pace in Q3. So next week’s retail sales and industrial production data should be robust. I envision at test on $1815-$1825,” he said.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.