After over 5 years, Tesla, Inc. (NASDAQ: TSLA) CEO Elon Musk is selling shares. Looking at the company’s market cap, this isn’t necessarily a bad idea as even though 6 months of sideways action; it still gained over 45% year-to-date.

See our latest analysis for Tesla.

Stock Options and Tax Bills

For the first time since 2016, Elon Musk started selling his shares in Tesla by exercising stock options that were a part of his compensation package.

In total, he sold 6.4M shares worth around US$6.9b. While his sale was announced through a poll on Twitter, a more observant eye might notice that the intention of sale appeared as early as September 14, when he filed a 10B5-1 form. This rule allows insiders of publicly-traded corporations to sell a predetermined number of shares at a predetermined time.

If it were not for an additional unscheduled sale, it would have looked like the Twitter poll was one of the many social media spins.

Here are key highlights to consider

- Since December 2020, Elon has owned 170.49m shares directly.

- His compensation options from 2012 expire in 2022.

- Exercising the options, he’d have tax liabilities for the price difference between 2012 and 2021 at a rate of 53%.

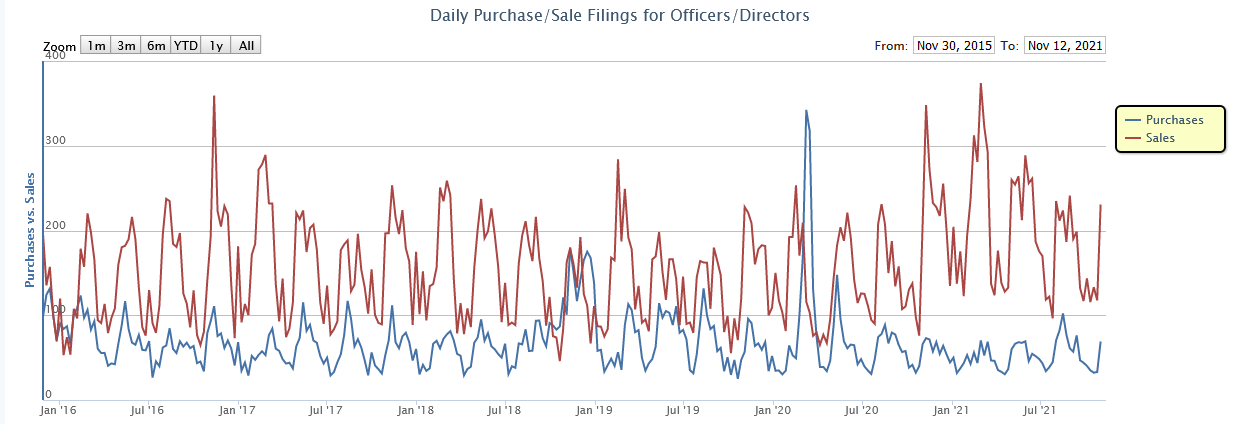

Meanwhile, the insider buy/sell ratio is on the move again. Last week it fell to 24.3%, indicating that insiders sold four times more shares than they bought. In general, this is taken as a bearish signal.

Who Owns Tesla Right Now?

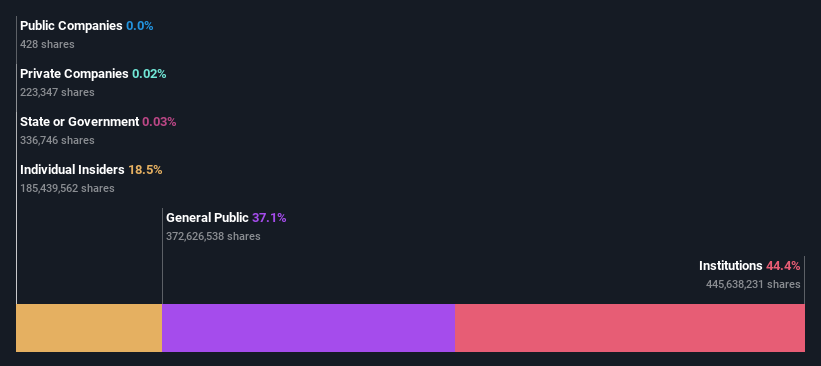

Tesla is a pretty big company. It has a market capitalization of US$1.0t. Typically institutions would own a significant portion of a company this size. Looking at our data on the ownership groups (below), it seems that institutions own shares in the company.

What Does The Institutional Ownership Tell Us About Tesla?

Institutions typically measure themselves against a benchmark when reporting to their investors, so they often become more enthusiastic about a stock once it’s included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

Tesla already has institutions on the share registry. Indeed, they own a good stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, they, too, get it wrong sometimes. If multiple institutions change their view on a stock simultaneously, you could see the share price drop fast.

Hedge funds don’t have many shares in Tesla. Looking at our data, we can see that the largest shareholder is CEO Elon Musk, with 17% of shares outstanding. With 6.2% and 5.3% of the shares outstanding, respectively, The Vanguard Group, Inc. and BlackRock, Inc. are the second and third largest shareholders.

After doing more digging, we found that the top 23 have the combined ownership of 50% in the company, suggesting that no single shareholder has significant control over the company.

Insider Ownership Of Tesla

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management runs the business, but the CEO will answer to the board, even if they are a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions, too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Tesla, Inc. It has a market capitalization of just US$1.0t, and insiders (mainly Mr.Musk) have US$192b worth of shares in their names. That’s quite significant. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

The general public, with a 37% stake in the company, will not easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favor, they can still make a collective impact on company policies.

Next Steps:

Despite a significant insider sale, we don’t think this signals a negative sentiment change for Tesla. The situation was rather clear from the start as 9-year old options had to be exercised before expiry while also generating a significant tax bill.

While Treasury Secretary Janet Yellen has been advocating for a tax on unrealized capital gains that would force such sales all around – this is likely unconstitutional. Not to mention that it would probably cause a recession and a significant market downturn.

Although it is well worth considering the different groups that own a company, other factors are even more important. To that end, you should be aware of the 3 warning signs we’ve spotted with Tesla.

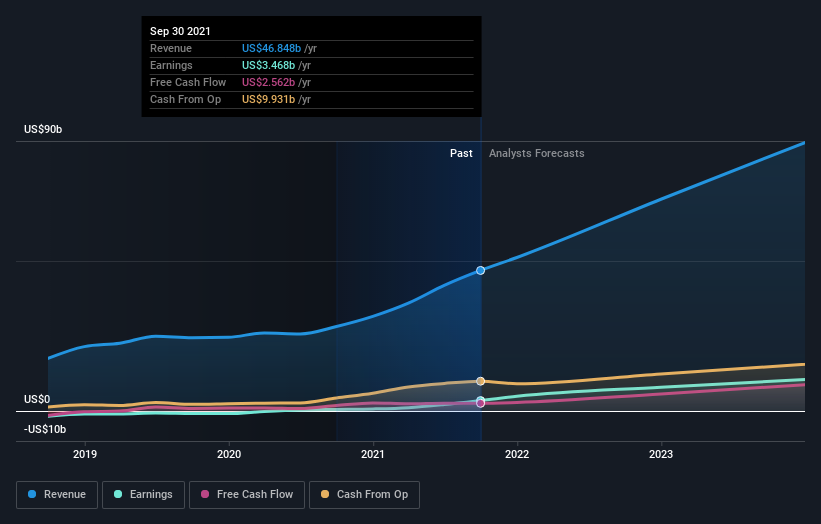

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the previous date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com