A crude oil tanker is seen at Qingdao Port, Shandong province, China, April 21, 2019. REUTERS/Jason Lee/File Photo

TOKYO, Nov 18 (Reuters) – The world’s biggest economies said on Thursday they were looking into releasing oil from their strategic reserves, following a rare request from the United States for a coordinated move to cool global energy prices.

The U.S. move reflects frustration with the Organization of the Petroleum Exporting Countries (OPEC) and allies such as Russia who have rebuffed Washington’s requests to speed up oil production as the world economy rebounds from the pandemic.

It also comes as U.S. President Joe Biden fends off political pressure ahead of midterm elections next year over rising gasoline prices and other costs driven by the recovery.

The Biden administration has asked big oil buyers such as India and Japan – as well as China for the first time – to consider releasing stocks of crude, several people familiar with the requests told Reuters.

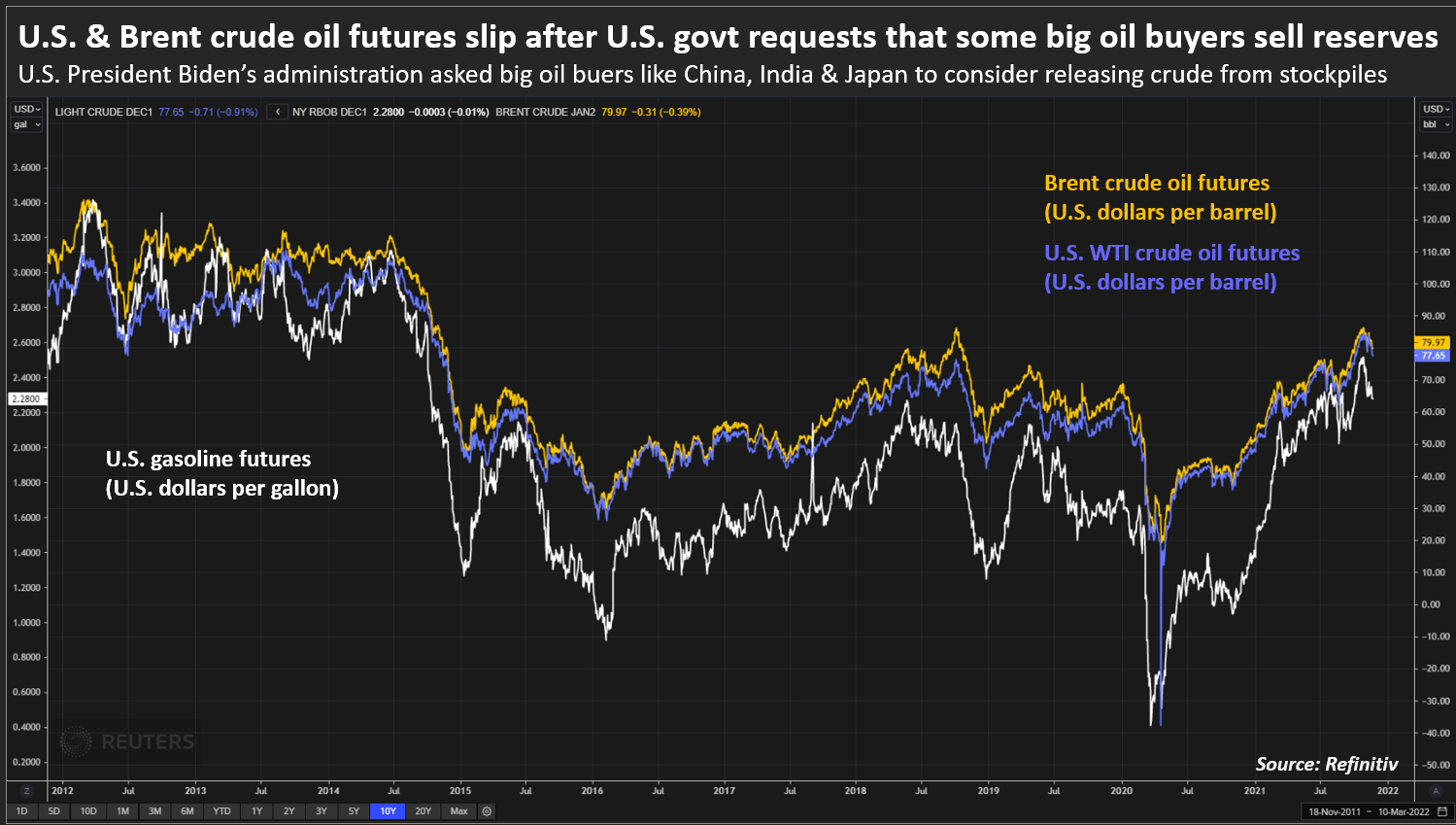

Oil prices sank about 4% to a six-week low after Reuters reports about the U.S. request and China’s decision to release some crude, before recovering some ground later on Thursday.

“Brent is now under 80 bucks,” said John Driscoll, managing director at consultancy JTD Energy in Singapore. “It’s having a short-term effect on oil markets. It’s probably good for at least a 5% correction.”

China’s state reserve bureau told Reuters it was working on a release of its crude oil reserves, although it declined to comment on the U.S. request.

A Japanese industry ministry official said Washington had requested Tokyo’s cooperation in dealing with higher oil prices but he could not confirm whether the request included a coordinated releases of reserves. By law, Japan cannot release reserves to lower prices, the official said.

UNPRECEDENTED CHALLENGE

A South Korean official confirmed the United States had asked Seoul to release some oil reserves.

“We are thoroughly reviewing the U.S. request, however, we do not release oil reserve because of rising oil prices. We could release oil reserve in case of supply imbalance, but not to respond to rising oil prices,” the official said.

The United States and its allies have coordinated strategic petroleum reserve releases before, such as in 2011 when supplies were hit by a war in OPEC member Libya.

But because the current proposal involves China for the first time, it represents an unprecedented challenge to OPEC, the cartel that has influenced oil prices for over five decades.

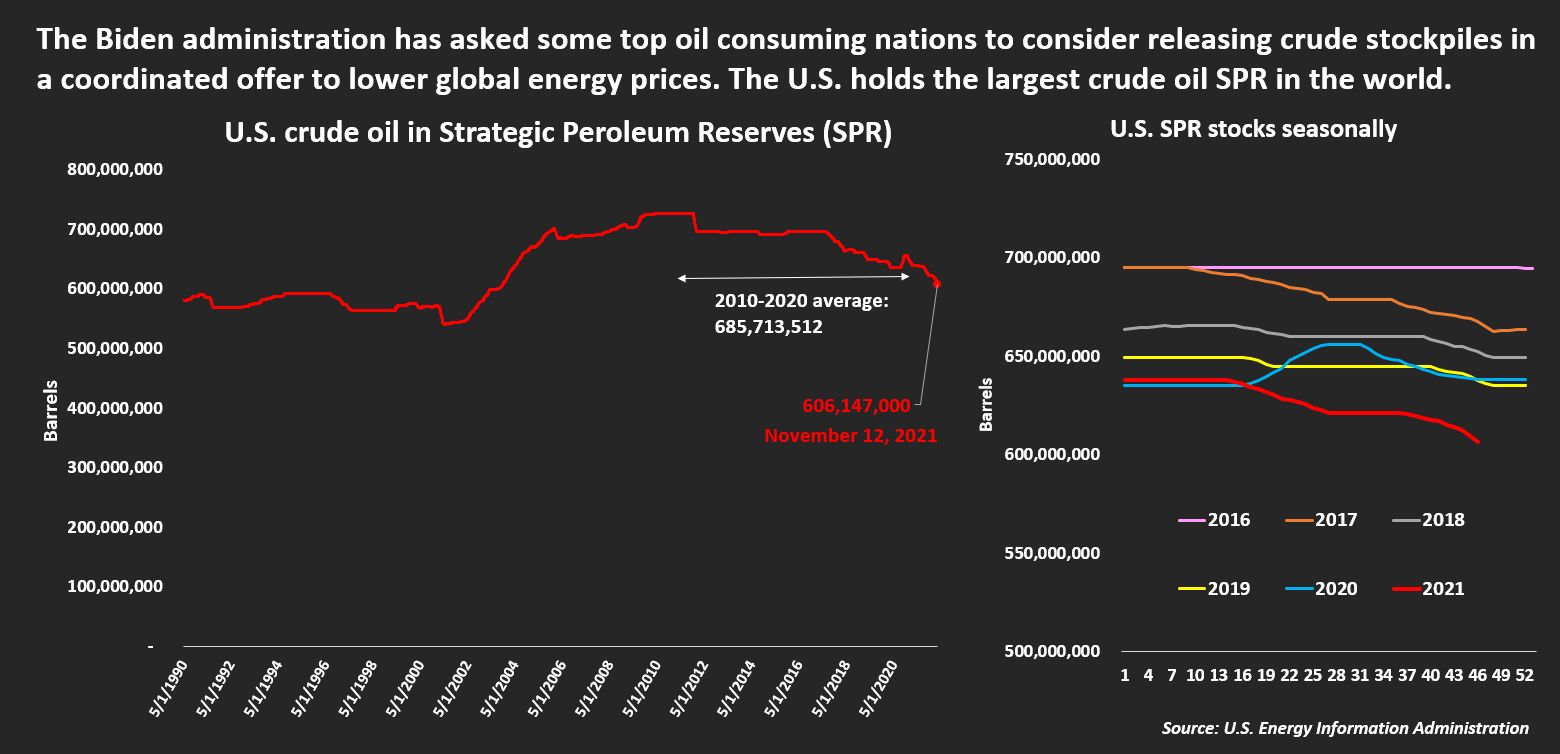

The U.S. SPR was set up in the 1970s after the Arab Oil Embargo to ensure the United States has adequate supply to weather an emergency.

If China is doing its release in coordination with other nations, it would be the first such time, said Sengyick Tee, analyst at Beijing-based consultancy SIA Energy.

China rolled out its first public auction of state crude oil reserves to a select group of domestic refiners in September, aiming to stabilise energy prices. read more

Biden and top aides have discussed the possibility of a coordinated release of stockpiled oil with close allies including Japan, South Korea and India, as well as with China, over the past several weeks, sources told Reuters earlier.

OPEC and other major producers including Russia, known collectively as OPEC+, have been gradually unwinding record production cuts made in 2020 by raising output by 400,000 barrels per day per month.

But they have resisted Biden’s calls for more rapid increases, arguing that the rebound in crude demand could be fragile and there were already signs of a surplus building in 2022. read more

The Biden administration had not addressed the “root cause” of high prices, which was limited domestic U.S. supply, said Tilak Doshi, managing director at Doshi Consulting in Singapore.

He cited the cancellation of the Keystone XL pipeline to bring oil from Canada’s Western tar sands to U.S. refiners, and bans on drilling on Federal lands.

The Biden administration had been “doing everything to stymie domestic oil and gas producers,” Doshi said, adding that he believed Washington’s call for a coordinated response from allies plus China was a first.

Reporting by Yang Heekyong in Seoul, Aaron Sheldrick and Yuka Obayashi in Tokyo, Chen Aizhu in Singapore, Florence Tan in Singapore and Muyu Xu in Beijing; Editing by Stephen Coates and David Clarke

Our Standards: The Thomson Reuters Trust Principles.