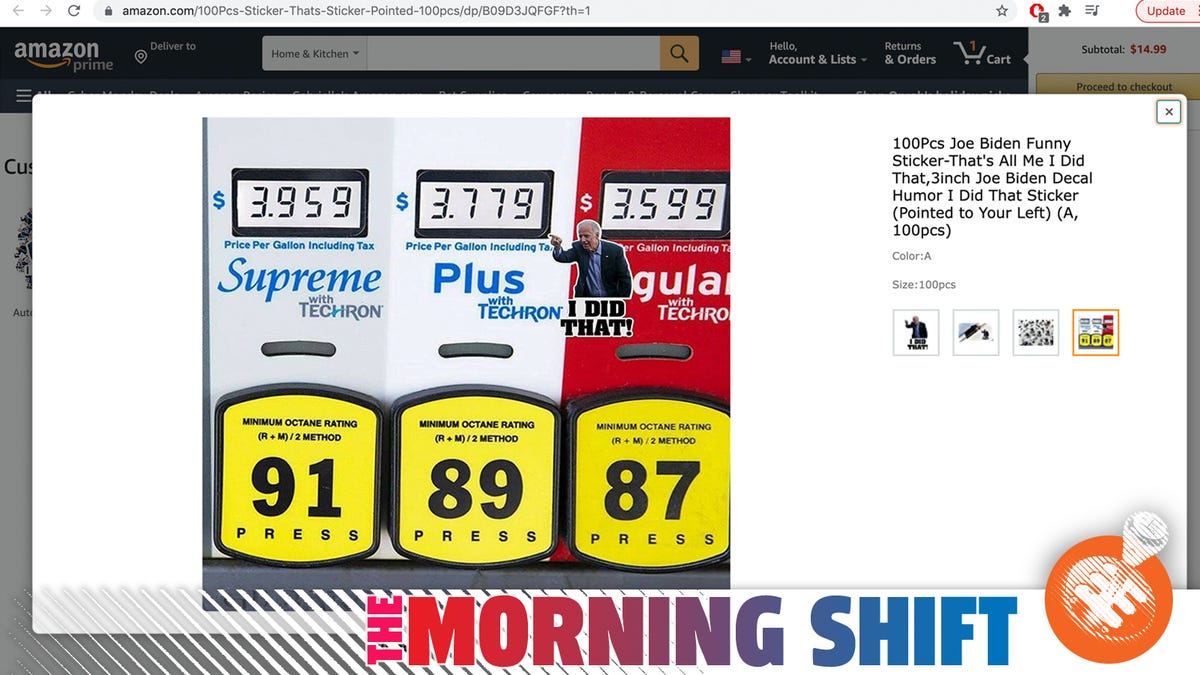

If you’ve filled up recently and spotted yet another “I did that” sticker at the pump, get ready for gas prices to get even more stupid. All that and more in The Morning Shift for November 29, 2021.

1st Gear: Oil Prices Working Back Up After 10% Plunge

Friday saw the biggest one-day drop in oil prices since the start of the pandemic, and while prices have crept back up on Monday, I suspect things will only get more stupid from here. Here’s Friday’s news of the new Omnicron variant tag-teaming with Biden releasing a glut of crude from our strategic reserve, as the Financial Times explains:

Oil prices plunged more than 10 percent on Friday as reports of a virulent new coronavirus variant sparked fears of more pandemic lockdowns and another blow to fuel demand, just as the US plans to release more supplies on to the market.

[…]

Both of the oil markers had their biggest one-day declines since the WTI price briefly went negative in April 2020 at the height of the pandemic.

The falls in price came days after the White House, concerned about soaring petrol costs and widespread inflation, announced that it would release 50m barrels of crude from its Strategic Petroleum Reserve over the coming months — the biggest-ever drawdown of oil from the government stockpile — in conjunction with added contributions from five other countries.

Oil prices have hopped back up a bit today, per Reuters:

Friday’s slide, the biggest one-day drop since April 2020, reflected fears that travel bans would hammer demand. The plunge was exacerbated by low liquidity due to a U.S. holiday and the expected demand hit does not justify such a fall, analysts said.

“The fear factor had its grip on financial markets on Friday,” said Norbert Ruecker of Swiss bank Julius Baer. “Fundamentally, the announced and enacted international air travel constraints cannot explain such a sharp slump.”

G/O Media may get a commission

15% Off

Vicseed Car Phone Suction Mount

It can hold a tire, for Pete’s sake

This super strong suction mount can keep so much more than your phone exactly where you want it. But we recommend using it for your phone. Obviously.

This is all to say that if Covid gets worse as fall turns into winter, we can expect to see gas prices drop. Basically, if you see the price of gas drop, know that it’s because the world is getting worse.

2nd Gear: Nissan Is Throwing $18 Billion At EVs

Nissan announced a new plan for 2030, and it means throwing a ton of money at EVs and its hybrids. From Nissan’s press release:

As a pioneer of electric vehicles (EVs), Nissan has democratized EVs and invested in building charging infrastructure and energy management. By placing electrification at the core of the company’s long-term strategy, Nissan Ambition 2030, the company aims to accelerate the electrification of its vehicle lineup and rate of technology innovation with investments of 2 trillion yen over the next five years.

Based on customer demands for a diverse range of exciting vehicles, Nissan will introduce 23 new electrified models, including 15 new EVs by fiscal year 2030 aiming for an electrification mix of more than 50% globally across the Nissan and INFINITI brands.

With the introduction of 20 new EV and e-POWER equipped models in the next five years, Nissan intends to increase its electrification sales mix across major markets by fiscal year 2026, including:

• Europe by more than 75% of sales

• Japan by more than 55% of sales

• China by more than 40% of sales• The United States by 40% of EV sales in fiscal year 2030

It is funny to see the U.S. last in that ranking. Maybe Nissan is as aware as anybody else that the Ariya might not be a Tesla-grade hit. Then again, even a Tesla-grade hit doesn’t make that big of a dent in the total American car market.

I’ll also say that normally anything that lumps EVs in with hybrids annoys me, but Nissan’s e-power cars are fully driven by electric power, they just have engines to work as range-extenders. Not the worst thing.

3rd Gear: Lithium Mining Is Coming Home, So Now Everyone Wants Clean Lithium

Lithium mining has largely been done in the farther corners of the world, like the desert in Chile, where the global elite can pretend bad things aren’t happening. Now, more and more lithium mining is happening right in the global elite’s backyards, like in Germany. Read up here in Automotive News Europe:

Stellantis has signed a preliminary deal with lithium developer Vulcan Energy Resources for the supply of climate-friendly lithium from Germany, the automaker said on Monday.

Stellantis is the latest automaker to sign a deal with the German-Australian start-up to lock down supplies of the battery metal ahead of an expected surge in global demand as a transition towards cleaner mobility gains traction.

[…]

Vulcan is one of a number of companies testing a direct lithium extraction (DLE) method that uses less land and groundwater, making it more sustainable than the most-common existing methods of open-pit mines and brine evaporation ponds.

See how this extraction project preaches sustainability and cleanliness now that there’s a real risk of bad press?

4th Gear: Striking Coal Miners Explain How Private Equity Makes Profits As Workers Take Cuts

Speaking of mining, there’s a good article in the Financial Times about the historiccal miner strike going on here in the States, laying out how workers are suffering as their employers cash out:

Striking miners at an Alabama coal company want better pay and benefits from management, but they are pushing their case by focusing on the company’s former owners in the private equity industry.

Apollo Global Management, Blackstone and KKR were among the previous owners that shared the bulk of almost $800m in dividends after the company, Warrior Met Coal, was formed out of a bankruptcy reorganisation in 2016.

The miners’ union argues that those special payouts were made at their expense.

The labour stand-off has put a spotlight on “dividend recapitalisations”, in which a portfolio company borrows to pay a special dividend to its owners. Three US senators this month sent a letter to Apollo and Blackstone criticising their gains at Warrior, saying that they “appear[ed] to have made off like bandits”.

That this system is fucked up is obvious, that it clearly can’t last is going to become even more apparent over the coming years.

5th Gear: Car Dealers Are Still Whining About EVs

Markets Insider interviewed a bunch of car dealers about the general trend towards going EV and boy, everyone was just so jazzed to be helping save the environment and the economy at the same time. What’s that? They’re complaining?

“So many of the questions aren’t even about the car,” said Joe Jackson, general sales manager at suburban Detroit Bowman Chevrolet.

Which is a concern for dealers well versed in the myriad details of gas power. The inability to give a compelling answer — about home versus public charging, range anxiety, safety, and more — could risk the loss of a sale altogether.

“When we polled dealerships, they did not feel well equipped at all to answer those questions,” said Mike Dovorany, automotive and mobility vice president at the market research firm Escalent. In an effort to help dealers get ready for EVs, GM has been providing its dealers with resources like designated EV curricula and regional field managers.

I actually have to give it to the dealers for worrying about one thing: the fear that chargers installed today could be obsolete tomorrow:

“The biggest pain point is putting in the chargers, how much that costs, finding the space in your store depending how big your store is, where do you put it,” said the EV educator Nigel Zeid.

[…]

Being too early an adopter comes with some risk, dealers said, like installing infrastructure that could quickly become obsolete. “The technology is always changing,” said Jackson, who installed eight more chargers at his two buildings this year to prepare for future product, “but we feel comfortable with the investments we’ve made this year.”

I would not want to be the guy who installs a ton of CHADeMO chargers just as everyone switches to CCS!

Reverse: He Really Peaked With The Ford Falcon

Neutral: Where Does Nissan Fit Into The History Of EVs?

In some ways, you have to look at Nissan’s modern EV efforts as a failure. It was upstart Tesla, not Nissan, that made EVs desirable. But Nissan is also the most steady and consistent player out there, producing lithium-ion electric cars pretty much without a break since the 1990s.