Shares of Tesla Inc. charged higher Monday, after the electric vehicle market leader was upgraded by Credit Suisse analyst Dan Levy as he turned bullish, saying the recent selloff has created an “attractive” level for investors to buy, while fundamentals remain “highly favorable.”

Levy raised his rating to outperform, after being at neutral since April 2020. He kept his stock price target at $1,025, which implies about 15% upside from current prices.

The stock

TSLA,

+9.73%

shot up 5.4% in morning trading, after tumbling 19.4% over the past two weeks. It was trading about 27% below the Nov. 5 record close of $1,222.09.

Levy said the weakness in the stock market over the past month, amid fears of rising inflation and interest rates and macro uncertainty, has been “disproportionately punishing” growth stocks. Tesla was not immune, and has fallen enough that “an attractive entry point has emerged” to buy into a company that Levy believes is “at the heart” of the multi-decade secular transition to EVs.

“Tesla is a 1 of 1: we are hard pressed to find a stock that checks all the boxes as Tesla does — attractive growth story (both top-line and EPS), disruption, decarbonization, etc.,” Levy wrote in a note to clients. “Accordingly, with robust fundamentals ahead and with the stock having been caught in the market decline, we believe the stock should recover.”

Tesla had reported last week fourth-quarter earnings that were well above analyst expectations, but the stock fell after the company revealed that factories had been running below capacity for months as a results of supply-chain constraints.

Don’t miss: Tesla stock falls as EV maker throws ‘curveballs’ at bulls.

The supply chain issues didn’t deter Levy, however, who said he expects further volume growth and sustained margin strength in the coming years, relative to peers.

“With less question around demand and much more question around supply of EVs, Tesla should be a key beneficiary — it has a product lead vs. others, and has taken the most holistic approach in EV supply,” Levy wrote. “Not only does Tesla not have to tackle the challenges that legacy [original equipment manufacturers] must address (margin dilution, manufacturing transition, distribution), but Tesla also has leads in supply/vertical integration, software, product simplicity, and capital availability.”

FactSet, MarketWatch

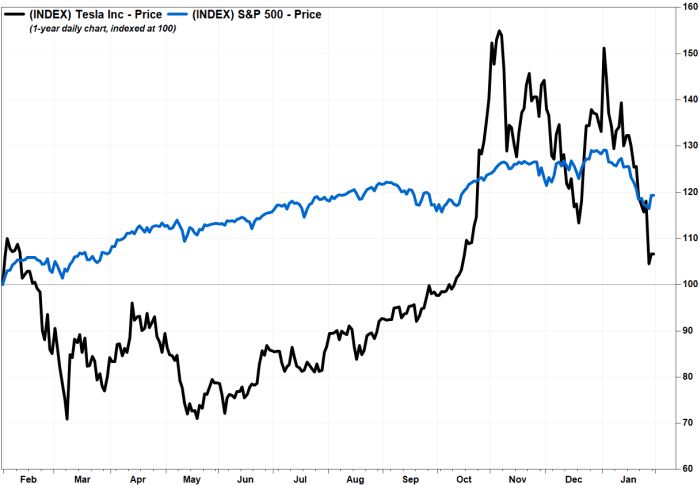

Tesla’s stock has tumbled 19.9% over the past three months, but has rallied 12.5% over the past 12 months. In comparison, the S&P 500 index

SPX,

+1.26%

has slipped 3.5% the past three months and run up 19.7% the past year.