NEW YORK, Feb 15 (Reuters) – Wall Street surged in a broad rally on Tuesday, as signs of easing tensions along the Russia-Ukraine border brought buyers back to the stock market.

All three major indexes were sharply higher, with market leading tech and tech-adjacent stocks providing the biggest boost and putting the Nasdaq out front.

Geopolitical heat was turned down a notch after Russia said it had withdrawn some of its troops from the Ukraine border, prompting bullish equities sentiment and causing crude prices to slide on easing supply concerns.

Register now for FREE unlimited access to Reuters.com

Register

The announcement received guarded responses, and the United States and NATO said they had yet to see evidence of a drawdown. read more

“There seems to be a risk sentiment pop on the idea that the Russia-Ukraine situation might de-escalate,” said Ross Mayfield, investment strategy analyst at Baird in Louisville, Kentucky. “It’s pretty clearly a sentiment driven market.”

The CBOE market volatility index (.VIX) backed down from a three-week high.

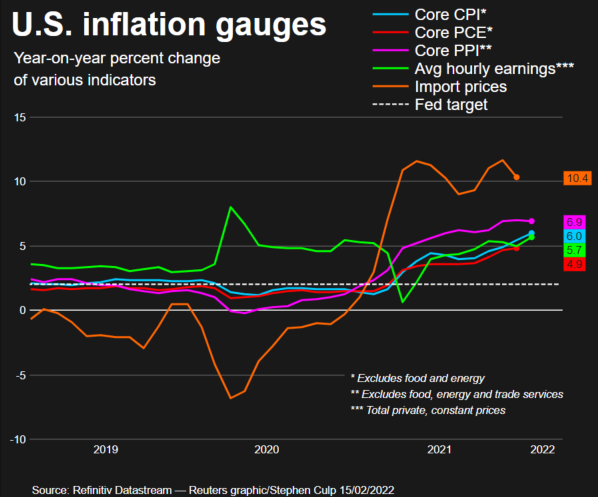

On the economic front, a report from the Labor Department showed producer prices surged in January at twice the expected rate, reinforcing economist expectations that the Federal Reserve will take on stubbornly persistent inflation by aggressively hiking key interest rates. read more

The graphic below shows producer price index (PPI) data, along with other major indicators, and how far they have risen beyond the Fed’s average annual 2% inflation target:

The market has now priced in better than even odds that the central bank will raise the Fed funds target rate by 50 basis points at its March monetary policy meeting.

“The market is now priced for a more aggressive Fed, and outside of geopolitics there’s reduced uncertainty,” Mayfield added. “But the market is never certain so you always dealing probabilities.”

The Dow Jones Industrial Average (.DJI) rose 409.43 points, or 1.18%, to 34,975.6, the S&P 500 (.SPX) gained 64.65 points, or 1.47%, to 4,466.32 and the Nasdaq Composite (.IXIC) added 294.04 points, or 2.13%, to 14,084.96.

Nine of the 11 major sectors in the S&P 500 were higher, with tech shares (.SPLRCT) enjoying the largest percentage gain. Energy stocks, (.SPNY) weighed by sliding crude prices , , were down the most.

Fourth quarter reporting season is entering its last stretch, with 370 of the companies in the S&P 500 having reported. Of those, 78.1% have beaten analyst estimates, according to preliminary Refinitiv data.

“It’s nice to have that earnings strength underlying these macro issues,” Mayfield said.

The Philadelphia SE Semiconductor index (.SOX) surged 4.8% following Intel Corp’s announcement of a $5.4 billion deal to buy Israeli chipmaker Tower Semiconductor (TSEM.TA). read more

Restaurant Brands International rose 4.4% after the fast food operator beat quarterly profit and revenue estimates. read more

Hotelier Marriott International (MAR.O) also beat Street expectations due to rising occupancy rates, sending its shares up 4.8%. read more

Other travel-related companies surged, with the S&P 1500 airlines index (.SPCOMAIR) and hotels/restaurants/leisure index (.SPCOMHRL) rising 5.7% and 2.4%, respectively.

Shares of cloud infrastructure company Arista Networks jumped 6.3% after forecasting better-than-anticipated current quarter revenue.

Advancing issues outnumbered declining ones on the NYSE by a 3.50-to-1 ratio; on Nasdaq, a 4.07-to-1 ratio favored advancers.

The S&P 500 posted 6 new 52-week highs and 3 new lows; the Nasdaq Composite recorded 35 new highs and 57 new lows.

Register now for FREE unlimited access to Reuters.com

Register

Reporting by Stephen Culp; additional reporting by Devik Jain, Susan Mathew and Shreyashi Sanyal in Bengaluru; Editing by Aurora Ellis

Our Standards: The Thomson Reuters Trust Principles.