Ask any manufacturer what they think of manufacturing sales; they’d reply to your question with one word: complex.

What is manufacturing sales?

Manufacturing sales happens when a manufacturer sells their products – finished goods from raw materials or components. Well, at least that was an appropriate definition pre-Industry 4.0, pre-digitalization, and pre-consumerization.

Nowadays, manufacturing sales needs to do so much more. Smart manufacturing methods drive rapid innovation across all verticals with 24/7 online sales is becoming the norm in the industry, and manufacturers are making every effort to adapt to B2C expectation levels.

What makes manufacturing sales complex?

For the answer to become obvious, you need to understand the key difference between B2B and B2C sales. In B2C, a company sells to a consumer; for example, Tesla sells a car to your neighbor. In B2B, a company sells to another business; for example, a manufacturer of steering systems sells to Tesla.

In the first case, the transaction is relatively straightforward. It involves one or very few decision-makers, is driven by personal expectations, and sold through a price that is known, and in comparison, small.

In the second, the business buying the product looks for manufacturers that meet their technical requirements for a specific component of their vehicle. They then start a selection process that involves multiple suppliers of the same component submitting their proposals.

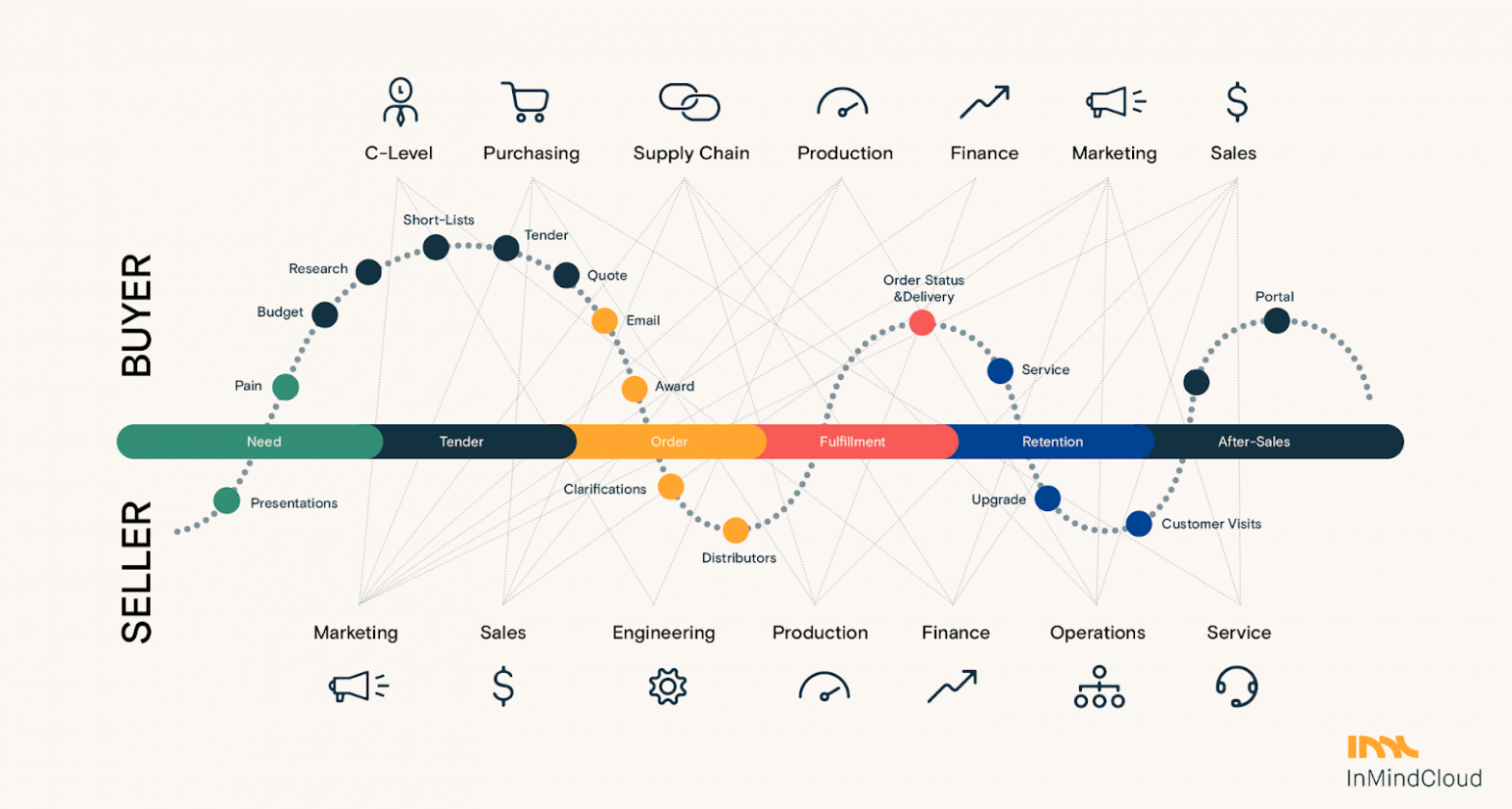

Throughout this process, various stakeholders from Tesla can be involved in the requirements setting, budgeting, and research process. Meanwhile, the suppliers need to engage in a series of tasks. It starts from gathering requirements, and using the information gathered to begin design, engineering, calculations, part configurations, material and production simulations, pricing and ultimately creating a tender document.

This process involves salespeople, engineers, material and production experts, procurement, and middle-management decision-makers. The entire quoting process can take up to several weeks and incur a high cost of sales.

At this point, we have not even painted a complete picture of this journey. Often, negotiations or corrections can easily send this process into a repeat loop. And when the buying business makes the final order, another set of complexities come into play. Factors such as labor dynamics, material costs, or any unforeseen production circumstances could threaten the successful delivery of the product or manufacturing solution.

You can conclude that in B2B manufacturing sales, the buying journey and the selling process are a winding path of multiple dependencies. It involves a high number of stakeholders and carries significant risk from errors or delays for both the buying business and the manufacturer.

Having a complicated buying process in the manufacturing industry was accepted as the norm. But research has shown that B2B enterprises like manufacturers, need to overcome it in order to recover during economic downturns.

Evolving market challenges for manufacturers

Adding to the complexities of the B2B sales process, manufacturers are faced with four main market challenges that force them to rethink their sales and business models.

1. Global competition

Globalization is not a new challenge for manufacturers. But with the rise of digital opportunities, manufacturers across the globe are able to sell and market to the same customers. The digital economy is giving manufacturers longer reach than ever. Local manufacturers now have to compete against manufacturers based in other parts of the world. With competition intensifying, slim margins are expected to tighten even more.

2. Customer expectations

B2B decision-makers are now increasingly consumerist. They are demanding a seamless and smooth customer experience. They expect customization for already complex products and solutions. They want matching service offers, convenient purchasing and self-service models, and at the very least, high responsiveness and better customer service.

3. Market volatility

Manufacturers traditionally struggle with market volatility. Factors such as raw material prices, labor costs, or political changes can affect their supply chains and sales markets. Global economic fluctuations can impact a less agile industry such as manufacturing disproportionally harder than other sectors.

4. Industry 4.0 opportunities

The fourth industrial revolution has opened new horizons for manufacturers. They now have access to technology that can transform their productivity, speed, and flexibility. Emerging technology like cyber-physical production systems (CPPSs), Industrial Internet of Things (IIoT), Assisted Intelligence, and cloud computing, help manufacturers build smarter factories.

One of the primary opportunities arising is the cost-efficient production of mass-customized products in a lot size of one. The challenge, however, is that manufacturers are not agile enough to adopt these new technologies, and lack clear strategies to successfully implement emerging technology.

Manufacturers leading the market today have strategies that help them stay ahead. They overcome market challenges by constantly adapting how they sell and operate their business so they can solidify their market position and mitigate the risk of revenue loss.

5 industries that use advanced manufacturing sales

In manufacturing, each sub-vertical has its own way of operating. The differences can be found in the way manufacturers use labor, machines, tools, and chemical or biological processing. Understanding the differences can help manufacturers look for strategies to cope with market challenges, or sales complexities.

Medtech and high technology

The medical device and technology industry (medtech) covers medical instruments and equipment used for diagnostics, monitoring, and therapeutics. Medical device manufacturers produce surgical instruments, diagnostics apparatus such as ultrasound instruments, and medical devices like pacemakers. Technologies such as 3D imaging, additive manufacturing, coatings and surface treatments, micromanufacturing, and even nanotechnology come into play.

The high-tech manufacturing industry produces cutting-edge technology products from computers to plane engines. Advanced machinery is used to manufacture components and parts (such as semiconductors and circuit boards).Processes such as forming, casting, molding, and laser engineering are used.

Sales in these industries are characterized by a high complexity in; production and sales, a competitive market landscape, and high costs. Manufacturers in these sub-verticals focus on supply chain efficiency and demonstrate high agility while keeping costs and inventory levels low. Increasing market share and expanding a global sales force or distribution network are significant challenges for businesses in medtech and high-tech.

Steel and metal

The steel and metals production industry uses various raw metals to fabricate structures, machines, tools, and parts. Value-added processes include welding, cutting, forming, metal stamping, forging, casting, and machining all of which require engineering designs. This industry struggles with volatile raw material prices and a general slowdown in demand. As a result, steel and metal manufacturers take extra care in aligning supply and demand while keeping track of their highly diverse customer requirements.

Machinery and equipment

Industrial machinery and equipment manufacturers design, fabricate and assemble various products. These products can range from small-scale machines to industrial components or tools. Buyers are from sectors like agricultural, construction, mining, aviation and aerospace, defense, and maritime.

Machinery and equipment manufacturers also serve other verticals that require industrial equipment like robotics and pumps. This industry primarily deals with rising global competition and commoditization of hardware which causes massive price pressure.

Electrical equipment

The electrical equipment and electrical components industry manufactures products that generate, distribute, or use electrical power. Products can be things such as batteries, sensors, electrical wiring, lighting equipment or motors, generators, and transformers. This industry depends on efficient operations, economies of scale in purchasing materials and production, and of course, technological expertise. In addition, manufacturers in this vertical seek to balance costs versus customer requirements and short innovation cycles while keeping a close eye on margins.

Automotive and suppliers

The automotive industry is a significant economic global force that designs, develops, and manufactures motor vehicles. Auto parts and components manufacturers are suppliers for the automotive industry. They produce components that become part of the automobile, such as brakes, suspension, steering systems, engine parts, safety management, climate control equipment, engine cooling and exhaust systems, and interior and cockpit modules.

They can be classified in tiers one to three in a supplier pyramid depending on the hierarchical order (tier one supplies directly to the manufacturer). The entire industry is transforming at lightning speed, resulting in short innovation cycles. Suppliers are facing massive price pressure through global competition and volatile material costs. At the same time, suppliers in the industry usually commit to multi-year contracts. Their focus must be on margins, successful international sales, and new business opportunities in digital channels.

6 types of manufacturing that defines sales

By now, you learnt that manufacturing sales strategies are dependent on market conditions and can be influenced by industry-specific factors. Another factor that can determine the way manufacturers sell, is the manufacturing system or type used to produce their products. Finally, various business models are developed to balance out the costs of producing the product while meeting customers’ demands.

1. Make-to-stock (MTS)

This method is used by factories that produce goods that are then stocked in warehouses or stored in showrooms. Manufacturers that found success with this business model understand that demand must be somewhat predictable and precisely forecasted. That is because the manufacturer expends capital to produce goods in advance. The capital then ends up bound in the finished goods until they are sold.

When a manufacturer overproduces goods, they would often apply aggressive discounts that eats into their margins to sell their goods and avoid writing them off. Underproduction means some market demand remains unserved, which gives competitors a chance to steal market share. In the case of MTS manufacturers, the sales complexity lies in forecasting demand before production.

2. Make-to-order (MTO)

In MTO businesses, goods are manufactured and sold when orders are received. In this model, inventories are easily managed, and the risk of overproducing is eliminated as market demands are clear. But in today’s consumerized B2B world, customers are increasingly becoming impatient. They don’t want to wait for their products to be produced.

Also, economies-of-scale in mass production is rarely applicable. Manufacturers cannot guarantee a steady stream of orders, so production costs and prices are likely higher due to low quantities. In the recent years however, Industry 4.0 technologies such as additive manufacturing (3D printing) are helping MTO businesses produce goods in lower quantities at lower costs. The industry term is lot size of one, where an MTO can produce a single product at the lowest possible cost.

Demand for customization in MTO is also on the rise. However, it is incredibly complex to sell. Cost calculations need to be immaculate for MTO businesses to achieve profitability.

3. Make-to-assemble (MTA)

Make-to-assemble or assemble-to-order (ATO) is a hybrid between make-to-stock and make-to-order. The manufacturer will produce components or parts in anticipation of orders for assembly. While the manufacturer is ready to fulfill customer orders instantly, he can also be left with unwanted parts or components when demand is low.

4. Configure-to-order (CTO)

Configure-to-order is a hybrid of make-to-stock and make-to-order. In CTO manufacturing, products are assembled and configured according to customer requirements. The subassemblies are made to stock and need to be immediately available at a well-predicted inventory levels to fulfill customer orders quickly. The final assembly is postponed until the order comes in, which helps manufacturers remain flexible enough to offer high product variety.

Just as in MTO, this model helps manufacturers cope in today’s competitive markets where tailored products with unique requirements are in high demand. The CTO system enables both mass customization, and fast response time in order fulfillment. In CTO manufacturing sales, the complexity lies in the configuration. End-product standards are predefined, but must be flexible enough to allow viable configuration.

5. Engineer-to-order (ETO)

Engineer-to-order is a manufacturing system that is often used for very complex or specialized products. The process starts once an order is received and involves design, engineering, and production. Products or solutions are engineered (or customized) by the manufacturer according to the customer’s specifications.

ETO manufacturing requires high subject matter expertise, meticulous requirements, engineering analysis, and high design effort. The costs tied to these requirements are high because of human resources needed, and must be maintained even before a customer orders. The manufacturer’s risk increases as production deadline, and cost estimates are added into the quote.

6. Manufacturing-as-a-Service (MaaS)

Manufacturing-as-a-service is a service-oriented business model that has existed since pre-industrial times when farmers brought their wheat to the mill to get flour. It is based on sharing manufacturing infrastructure to reduce costs and make better products.

In practice, customers define what needs to be made, and the manufacturer makes it. With the availability of Industry 4.0 digital technology (IIoT, additive-manufacturing, connectivity, big data, and cloud computing), MaaS becomes a highly flexible model that can produce faster, cheaper, and in any quantity, while keeping resource consumption under tight control.

On the other hand, it is highly dependent on streamlined and reliable supply chains. In the MaaS system, original equipment manufacturers (OEMs) effectively sell their process expertise. It requires a fully digitalized and connected production, and total transparency into their processes and costs.

Different manufacturing complexities

As you can see, each manufacturing system have risks related to supply and demand. This ultimately determines the complexity of manufacturing sales. A successful manufacturing business requires sales strategies that consider supply chain, stock management, production, engineering costs, and quality control.

The cost of sales usually increases with the level of complexity in engineering and design. To lower costs, manufacturers are turning to digital technology to automate time-consuming activities in the manufacturing sales process.

Manufacturing distribution models in B2B

A distribution channel is the path the manufacturer uses to deliver its products or service to the customer. The route can be as short as a direct interaction between the manufacturer and the buyer. It can also include several interconnected intermediaries like wholesalers, distributors, retailers, and more.

For manufacturers, it is vital to have a mix of distribution channels that complement their manufacturing type, create high availability for buyers and in target markets, and keep the cost of sales in check.

Direct sales (manufacturer to B2B customer)

In direct sales, no intermediaries are involved. The manufacturer or producer sells directly to its B2B customer. For example, a manufacturer of ophthalmic machines sells directly to an optics lab which uses it to produce spectacle lenses.

Direct selling is an excellent way to manage costs as the manufacturer has complete control over marketing, sales, and shipping. However, manufacturers are also increasingly setting up online stores to meet customer demands for self-service buying in B2B environments. Other channels could be B2B fairs and traveling sales representatives.

However, as the business grows, so does its distribution needs. To reach a larger consumer base or new markets, manufacturers might sell through intermediaries.

Indirect sales: distributor or partner sales

In indirect sales, manufacturers build up a network of partners, wholesalers, and retailers to meet business goals such as:

- Faster expansion

- Increasing brand recognition in larger sales networks

- Outsourcing sales operations costs

- Gaining access to new groups of customers or new market segments

In general, a wholesale buyer will stock large quantities of the manufacturer’s products, and sell them to further intermediaries in smaller amounts for a profit. Retailers, on the other hand, are store owners that sell the products to their customers directly.

Partner sales is an option when commercial knowledge in regions or language is beneficial towards the sale of goods. The manufacturer outsources the marketing and sales processes, but shipping remains in the manufacturer’s hands.

Risks for indirect distribution models are:

- A general lack of managerial control

- Lower profit per unit sold

- Risk of creating channel competition

- Coordination during the introduction of new products or implementation of changes

- Higher effort in brand maintenance

- Managing the sales network relationship

Manufacturing sales software solutions

The world of manufacturing is changing faster than ever before, and manufacturers need to adapt their selling methods constantly to meet their business goals. The tools they use vary in effectiveness, efficiency, and future viability.

Traditional industrial sales processes and software

Manual tasks and siloed operations are the characteristics of a traditional manufacturing sales process. However, regardless of the type of manufacturing, the manufacturer’s offer – also called quotation, request for quote (RFQ), request for information (RFI), or tender – always starts the seller-buyer relationship.

It often contains the details of the product, service, or solution requested. Its level of complexity depends on the type of manufacturing the product needs. In essence, it is a critical part of the manufacturing sales process, as it also sets the margins, and can determine a deal’s profitability.

Traditional sales methods rely on manual extraction of sales relevant data from sources such as the enterprise resource planning (ERP) system or product catalogs. This data is then processed through tools such as Excel to calculate costs, configure products or solutions and create offers.

This process is slow, lacks accuracy, and is prone to human or system error. This is especially true for the more complex manufacturing types such as CTO, ETO, and MaaS.

In addition, hundreds of dependencies, product variations, and cost factors require up-to-date information that cannot be guaranteed without connectivity. In addition, quotes often require input from various specialist departments, and final quotes need reviews and approvals. Errors and misalignment can send the entire process into a repeat loop.

The outcome of such a manual process is inadequate in terms of quality, margins, sales cycle time, and cost of sales. It is also not sustainable in highly competitive markets with demanding customers.

Digital sales software solutions: CRM, CPQ, e-commerce

Over the years, manufacturers have acquired or custom-developed solutions that could deal with complexity in quote creation. On-premise software to configure, price, and quote (CPQ) manufacturing products and solutions were implemented to fit very individualized IT landscapes.

With the rise of cloud computing and affordable internet around the globe, new solutions entered the market. The most relevant cloud software solutions for manufacturing sales are customer relationship management (CRM) software, CPQ, and e-commerce systems.

CRM

Manufacturers have evolved to be more innovative, connected, and customer-centric than ever. A manufacturing-focused CRM helps them achieve their new goals, and manage the complexity of all customer interactions.

At the same time, it keeps sales teams and distribution partners updated with the latest data from the manufacturer’s ERP, CPQ, or e-commerce systems. It provides manufacturers with a 360-degree customer view and enables them to match customer’s demands for speed and customization.

At its core, a CRM helps manufacturers manage and prioritize customers to:

- Drive successful sales outcomes with accurate customer data

- Manage customers and their needs across all channels

- Increase sales efficiency by automating the lead-to-order process

Typical functionalities of a manufacturing-focused CRM are customer account and contact management, purchase and conversation tracking, pipeline management, forecasting and reporting, and sales collaboration features.

CPQ

A CPQ is a central element in manufacturing sales. It enables manufacturing sales teams or channels, unprecedented access to all sales relevant data. It then assists with generating quotes for complex products faster, more accurately.

A tight integration to the manufacturer’s ERP is essential. But a CPQ’s true potential is realized when it is coupled with the CRM and e-commerce system.

A CPQ system digitalizes and automates the entire quotation process to:

- Create best-match offers from standard, to fully customized products and solutions

- Generate consistently accurate quotes and enable shorter sales cycles

- Help exceed buyer expectations with outstanding offerings on all selected channels

Classic features of a CPQ are product/service catalogs with smart selling functionalities, quote automation with workflows and approval routings, as well as product, service, and solution configuration.

Increasingly popular are interactive 2D and 3D visualizations for products and solutions. In addition, an essential feature for CTO and ETO businesses is manufacturing costing and pricing. And finally, a CPQ should tie all quote details together through quote management and document creation functionalities.

E-commerce

Customers expect a seamless buying experience with 24/7 access, even from B2B businesses. E-commerce solutions for manufacturers can be anything from a digital product catalog, an online store for the entire product and service offering, a spare parts online shop, or a partner, distributor, and dealer portal. They satisfy the demand for 24/7 business operability and provide fast business growth options at a very low cost, and high returns.

Commerce platforms make knowledge and products instantly available online to:

- Enable self-service purchasing for customers or partners who know what they want

- Empower distributors or partners to inform themselves, make inquiries, or purchase

- Deliver a seamless and error-free buying experience for after-sales and repeat-purchases

A manufacturing commerce platform typically delivers online shop modules based on manufacturing, configuration, and customer data. It securely restricts data access, and provides personalized offers for different buying groups.

It can include customer account discounts, promote install-base related products, or recommend spare parts and consumables that are relevant to the respective customer. Partner portals offer similar online buying experiences. In this case, the partner plays the role of the buyer, and can inquire, purchase, register equipment, or re-order consumables on behalf of their customers.

The role of the ERP in manufacturing sales

For manufacturers, the actual value of the before-mentioned software solutions comes into play when the software is interconnected and deeply integrated with the manufacturer’s ERP.

The ERP is at the heart of all manufacturing processes, and it houses:

- Product data

- Raw material information

- Engineering knowledge

- Configuration models

- Costs and prices

- Price lists, variant prices, account discounts

- Shipping costs and taxes

- Status of business commitments such as orders and purchases

- Stock availabilities and delivery times

- Region and sales channel specific calculation schemes

Years of work and evolving production knowledge are saved in a manufacturer’s ERP. A digital sales solution needs to make effective use of this knowledge and back-sync regularly to update information. Manufacturers looking to accelerate manufacturing sales can use a digital sales platform to connect all data sources, process steps, and stakeholders involved to build a seamless end-to-end process.

Customer centricity in manufacturing sales

As hard as the manufacturing sales process is, the B2B buying journey can be just as difficult. Today, buying a complex manufacturing solution involves six to ten decision makers. They are expected to gather product and seller information and use it to make the best buying decision possible for their business. Globalized markets bring even more options and solution providers to the evaluation table.

However, even when problems are well-defined, solutions are explored, and requirements clear, the buying group must still complete several tasks to select the best supplier, validate the process and find consensus. Circling back to our first graphic, you may notice that every complexity in the sales process matches equally complicated processes on the buyers’ side.

Manufacturers that understand that they have to simplify selling, but at the same time simplify how customers buy, have made the necessary shift in perspective to be successful. In addition, a focus on customer experience and aligning the customer journey with the sales process can repay in terms of higher win rates, bigger deal sizes, and customer loyalty.

Conclusion

You have learned just how complex manufacturing sales can be. It is shaken and shaped by market challenges, industry specifics, manufacturing type, and distribution mix. Digital sales solutions and industry 4.0 technology offer manufacturers the chance to react to these challenges and build agile and sustainable sales strategies for the future.

With digital manufacturing sales, manufacturers can protect margins, improve customer satisfaction, and, more importantly, increase revenue. A customer-centric approach ensures that manufacturers become easy to buy from and are equipped for the future of a consumerized B2B world.