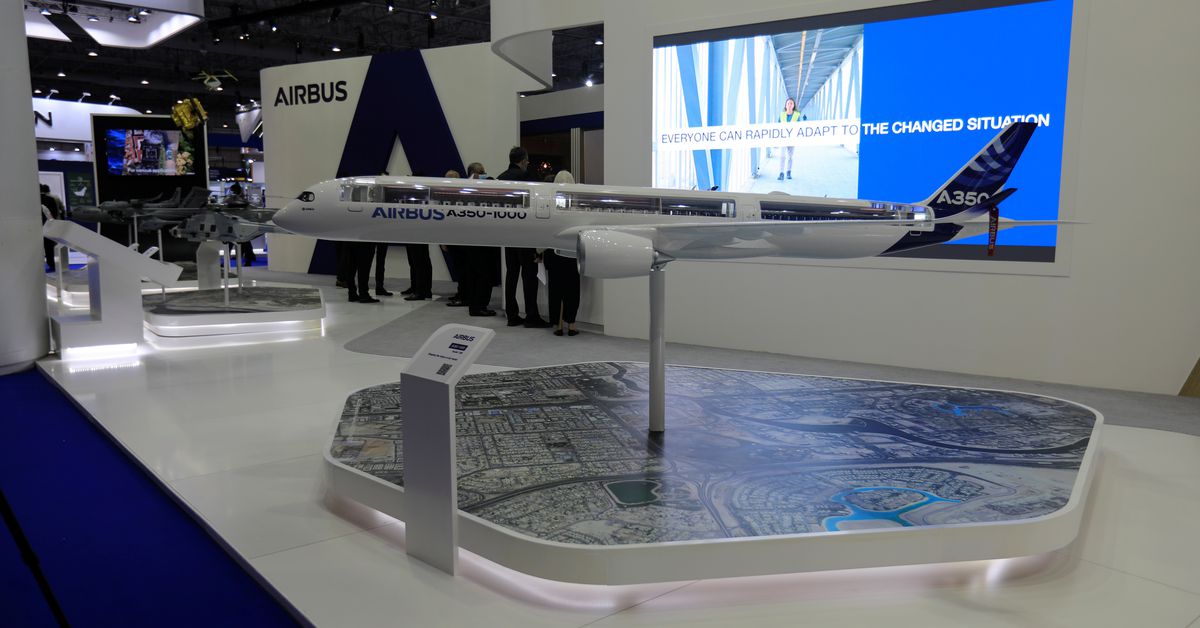

An Airbus A350 model is displayed at the Airbus pavilion during the Dubai Air Show in Dubai, United Arab Emirates, November 14, 2021. REUTERS/Rula Rouhana

DUBAI, Nov 14 (Reuters) – The nuts and bolts of post-pandemic trade loomed over the first major aerospace event since the coronavirus crisis on Sunday, as planemakers touted new freighters plans at the Dubai Airshow.

Plane giants Airbus (AIR.PA) and Boeing (BA.N) are hoping to launch the West’s first all-new flying juggernauts in 25 years as e-commerce gets a boost from the global pandemic.

Airbus, without a buyer after launching a freighter version of its A350 jet in the summer, was knocking on the door of one the industry’s go-to patrons for new plane launches, Steven Udvar-Hazy’s Air Lease Corp (AL.N), industry sources said.

And for best-selling small passenger planes, the founder of Hungarian low-cost carrier Wizz Air (WIZZ.L) was also seen ready to hand Airbus an order in Dubai, four years after taking part in a group of airlines striking a record deal at the same event.

Reuters reported in September that Wizz was in negotiations with Airbus over the purchase of at least 100 more jets.

Air Lease is expected to be among early customers for a long-haul A350 freighter alongside an unspecified cargo firm, industry publication The Air Current reported.

Airbus declined comment at the opening of the Dubai Airshow on Sunday, the first day of the Middle East industry event. Wizz and Air Lease were not immediately available for comment.

An A350 freighter would go up against a proposed cargo version of Boeing’s 777X passenger series, a twin-engined successor to the soon-to-be-halted 747.

Boeing has not launched the cargo variant but analysts say it is widely expected to do soon as it negotiates with potential buyers including major cargo player Qatar Airways.

Chief Executive Akbar Al Baker, who is locked in a dispute with Airbus over the quality of A350 passenger planes, said in June Qatar was in discussions over a possible 777X freighter.

Freighters have replaced jumbo passenger jets in typical dealmaking at the showcase event, as the industry looks to put on a brave face after losing two years of passenger growth to the global drop in travel caused by COVID-19.

In contrast to the passenger market, air freight is booming as consumers increasingly shop online while global supply chain constraints have limited the amount of cargo that can be moved.

MILITARY DELEGATIONS

Converted passenger jets are also riding the freight boom. Reykjavik-headquartered lessor Icelease announced an order for 11 Boeing 737-800 converted freighters on Sunday.

Chief Operating Officer Magnus Stephensen said demand for freighters would continue to expand even as passenger jets grounded by the pandemic return to the skies, putting currently unused capacity in their cargo holds back into the market.

“The COVID pandemic has changed the cargo environment for good,” he said. “E-commerce has entirely changed the outlook.”

Military officials also gathered as diplomats say Gulf states and neighbours are questioning Washington’s commitment to the region following a pull-out from Afghanistan.

Washington is the key security partner for the six Gulf Arab countries that include Saudi Arabia and the UAE, though European states have sought to increase their influence.

U.S. Lieutenant General Gregory Guillot, the top American air force general in the Middle East, said on Saturday the U.S. was committed to the region but that “size and presence could adjust” at times depending on what was happening elsewhere.

Israel has a public presence at the show for the first time after establishing diplomatic ties with the UAE last year.

Russia is due to present its Sukhoi Su-75 “Checkmate” fighter, a competitor to the U.S. F-35 that the UAE is buying as part of a deal with Washington following the establishment of diplomatic ties with Israel.

The Emirati deal has slowed as U.S. senators seek more control of arms deals, including assurances that weapons sales to Middle East countries won’t undermine Israeli security.

Reporting by Alexander Cornwell and Tim Hepher

Our Standards: The Thomson Reuters Trust Principles.