This has been quite a year for many industries, and not only because of sales rebounds after so many businesses were temporarily shut down during the early stages of the coronavirus pandemic.

Unprecedented stimulus payments by the federal government to consumers have helped feed pent-up demand, and with component supply disruptions, the most obvious distortion has been seen on auto-dealer lots.

This is why David Dineen, the chief investment officer for global small-cap at Spouting Rock Asset Management, believes that three large auto-dealer chains are well-positioned for stock-price gains in 2022 and beyond.

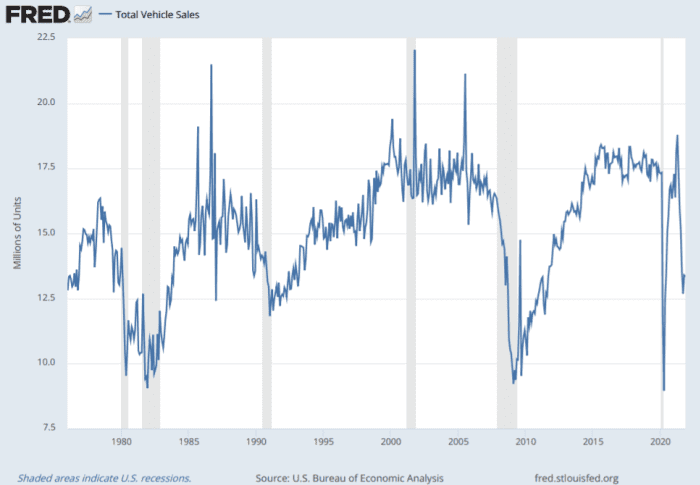

“We are coming off trough sales for this economic cycle” for new cars, he said during an interview.

Spouting Rock Asset Management is based in Bryn Mawr, Penn., and has $3.1 billion in assets under management.

The supply shortage has led to a decline in sales of new cars and light trucks to a seasonally adjusted annualized rate (SAAR) of 14.4 million units in October from a SAAR of 18. 8 million in April, according to the Bureau of Economic Analysis.

Federal Reserve Bank of St. Louis

Dineen described the October SAAR as “a recessionary level,” underscoring an opportunity for investors, because the auto dealers trade at lower valuations than auto manufacturers and parts suppliers.

Bad ‘comps’ for many industries in 2022

When covering financial results, Wall Street analysts and the financial media are fixated on year-over-year comparisons because of seasonality. But those “comps” can paint a confusing picture. For example, an industry whose sales dropped during the early days of the coronavirus pandemic in the first quarter of 2020 might have shown stellar “improvement” a year later, even if its sales hadn’t come close to recovering to pre-pandemic levels.

Artificially high year-over-year increases in sales, profits or cash flow this year may be followed by much slower growth rates as business in various industries gets closer to pre-pandemic norms.

According to Dineen, “you will have difficult comps for much of consumption in 2022.”

And that’s why he thinks large dealers who sell new cars are a good place for investors who wish to make another pandemic rebound play.

Low valuations for auto dealers

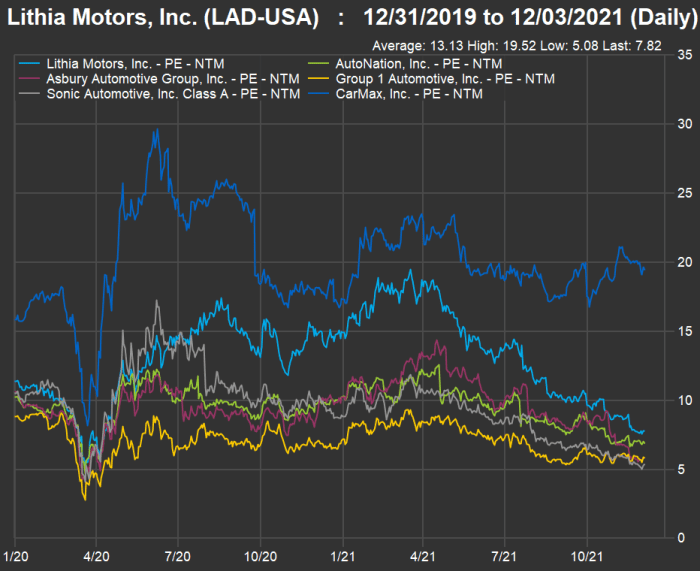

The auto dealers as a group have suffered a “re-rating” by investors as the shortage of new cars has caused sales to tumble, while creating upward price pressure and shortages of used cars.

To illustrate how this has affected stock valuations relative to earnings, we looked at the six auto dealers included in the S&P 1500 Composite Index

XX:SP1500

(made up of the S&P 500

SPX,

the S&P 400 Mid Cap Index

MID

and the S&P Small Cap Index

SML

). Here’s how forward price-to-earnings ratios for the six car dealers have moved since the end of 2019:

FactSet

The forward P/E ratios are based on rolling 12-month earnings estimates among analysts polled by FactSet. Click on the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

The exception to downward P/E movement for these dealers has been CarMax Inc.

KMX.

“CarMax has had the most leverage to the used car market, which has been on fire,” Dineen said. The five other dealers on the chart sell both new and used vehicles. Looking ahead over the next two years, as the supply chain presumably recovers and new-car production rebounds, he favors AutoNation Inc.

AN,

Asbury Automotive Inc.

ABG,

and Sonic Automotive Inc.

SAH

for an increase in P/E ratios and share prices.

For CarMax, comparisons may get “slippery” over the next two years, if a return to 2019 or 2020 sales levels for new cars causes the used-car market to cool, Dineen said.

Here’s an easier way to compare current forward P/E ratios for the six dealers in the Composite 1500 to their pre-pandemic levels. The list is sorted by market capitalization:

| Company | Ticker | Market cap. ($mil) | Forward P/E – Dec. 3, 2021 | Forward P/E – Dec. 31, 2019 | Average forward P/E since Dec. 31, 2019 |

| CarMax Inc. | KMX | $23,425 | 19.5 | 15.9 | 20.1 |

| Lithia Motors Inc. | LAD | $8,899 | 7.8 | 11.4 | 13.1 |

| AutoNation Inc. | AN | $8,164 | 6.9 | 10.3 | 9.6 |

| Asbury Automotive Group Inc. | ABG | $4,031 | 5.8 | 10.6 | 9.6 |

| Group 1 Automotive Inc. | GPI | $3,730 | 5.9 | 8.9 | 7.1 |

| Sonic Automotive Inc. Class A | SAH | $1,465 | 5.4 | 10.5 | 9.7 |

| Source: FactSet | |||||

In contrast to the three dealers he favors (AutoNation, Asbury and Sonic), Dineen pointed out that Ford Motor Co.

F

trades at a forward P/E of 9.8, while General Motors Co.

GM

trades at a forward P/E of 8.7. Meanwhile, auto-parts retailers trade much higher, with O’Reilly Automotive Inc.

ORLY

at a forward P/E of 21.6, AutoZone Inc.

AZO

at 18.3 and Advance Auto Parts Inc.

AAP

at 17.4.

Wall Street’s view

Here are expected compound annual growth rates (CAGR) for sales for the six dealers, based on consensus estimates through calendar 2023 among analysts polled by FactSet. Sales numbers are in millions.

| Company | Ticker | Estimated revenue – 2021 | Estimated revenue – 2022 | Estimated revenue – 2023 | Two-year estimated sales CAGR |

| CarMax Inc. | KMX | $27,946 | $30,102 | $30,372 | 4% |

| Lithia Motors Inc. | LAD | $22,700 | $27,224 | $32,416 | 19% |

| AutoNation Inc. | AN | $25,726 | $27,369 | $28,384 | 5% |

| Asbury Automotive Group Inc. | ABG | $9,623 | $15,236 | $16,290 | 30% |

| Group 1 Automotive Inc. | GPI | $13,676 | $16,343 | $18,034 | 15% |

| Sonic Automotive Inc. Class A | SAH | $12,343 | $16,890 | $18,684 | 23% |

| Source: FactSet | |||||

Here’s a summary of opinion among brokerage firms’ analysts polled by FactSet:

| Company | Ticker | Share “buy” ratings | Share neutral ratings | Share “sell” ratings | Closing price – Dec. 6 | Consensus price target | Implied 12-month upside potential |

| CarMax Inc. | KMX | 61% | 33% | 6% | $144.50 | $152.15 | 5% |

| Lithia Motors Inc. | LAD | 80% | 13% | 7% | $293.88 | $469.15 | 60% |

| AutoNation Inc. | AN | 33% | 67% | 0% | $124.57 | $156.13 | 25% |

| Asbury Automotive Group Inc. | ABG | 60% | 40% | 0% | $174.24 | $249.25 | 43% |

| Group 1 Automotive Inc. | GPI | 67% | 33% | 0% | $206.08 | $270.50 | 31% |

| Sonic Automotive Inc. Class A | SAH | 67% | 22% | 11% | $50.14 | $71.14 | 42% |

| Source: FactSet | |||||||

CarMax has 61% “buy” or equivalent ratings. However, the stock is close to its target price. The analysts see high double-digit upside for all the others, even though only a third rate AutoNation a buy.

How does Tesla fit in?

When asked about the long-term viability of new-car dealers, in light of Tesla Inc.’s

TSLA

non-dealer distribution model for its electric vehicles, Dineen said: “What really matters to us is valuation.”

“There is no question that Tesla is an awesome company,” he said, but he added that Tesla’s stock is “priced to win 100% of electric-vehicle sales.”

“When we look at automotive in general, we think the dealers make the most sense,” he said.

Don’t miss: Tesla’s stock is still cheap, says manager of new ETF who made Musk’s EV company its No. 1 holding