Max meant to list this valuable Bored Ape Yacht Club NFT for 75 ether, or $300,000, but listed it for .75 ether instead.

Yuga Labs

The Bored Ape Yacht Club is one of the most prestigious NFT collections in the world. You may scoff at the words “prestigious” and “NFT” being used so close together, but among its star-studded members are Jimmy Fallon, Steph Curry and Post Malone. Right now the price of entry — that is, the cheapest you can buy a Bored Ape Yacht Club NFT for — is 52 ether, or $210,000.

Which is why it’s so painful to see that someone accidentally sold their Bored Ape NFT on Saturday for $3,066.

Unusual trades are often a sign of funny business, as in the case of the person who spent $530 million to buy an NFT from themselves. In Saturday’s case, the cause was a simple, devastating “fat-finger error.” That’s when people make a trade online for the wrong thing, or for the wrong amount. Here the owner, real name Max or username maxnaut, meant to list his Bored Ape for 75 ether, or around $300,000, but accidentally listed it for 0.75. One hundredth the intended price.

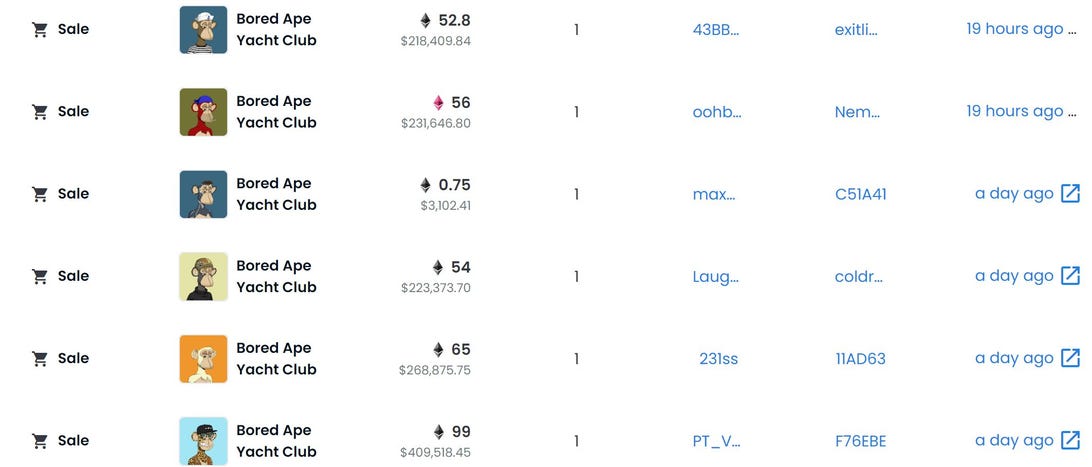

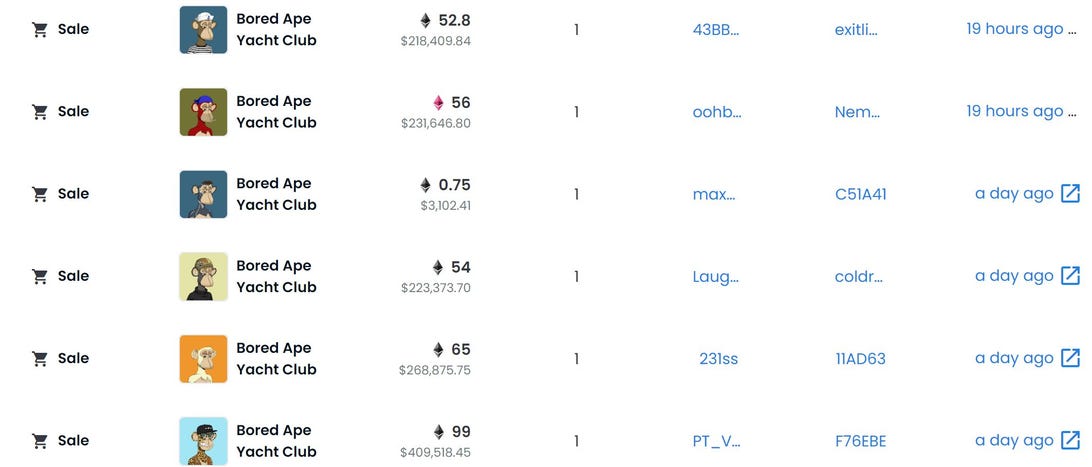

One of these sales is not like the others.

OpenSea

It was bought instantaneously. The buyer paid an extra $34,000 to speed up the transaction, ensuring no one could snap it up before them. The Bored Ape was then promptly listed for $248,000. The transaction appears to have been done by a bot, which can be coded to immediately buy NFTs listed below a certain price on behalf of their owners in order to take advantage of these exact situations.

“How’d it happen? A lapse of concentration I guess,” Max told me. “I list a lot of items every day and just wasn’t paying attention properly. I instantly saw the error as my finger clicked the mouse but a bot sent a transaction with over 8 eth [$34,000] of gas fees so it was instantly sniped before I could click cancel, and just like that, $250k was gone.”

Fat finger trades happen sporadically in traditional finance — like the Japanese trader who almost bought 57% of Toyota’s stock in 2014 — but most financial institutions will stop those transactions if alerted quickly enough. Since cryptocurrency and NFTs are designed to be decentralized, you essentially have to rely on the goodwill of the buyer to reverse the transaction.

Fat finger errors in cryptocurrency trades have made many a headline over the past few years. Back in 2019, the company behind Tether, a cryptocurrency pegged to the US dollar, nearly doubled its own coin supply when it accidentally created $5 billion-worth of new coins. In March, BlockFi meant to send 700 Gemini Dollars to a set of customers, worth roughly $1 each, but mistakenly sent out millions of dollars worth of bitcoin instead. Last month a company erroneously paid a $24 million fee on a $100,000 transaction.

Similar incidents are increasingly being seen in NFTs, now that many collections have accumulated in market value over the past year. Last month someone tried selling a CryptoPunk NFT for $19 million, but accidentally listed it for $19,000 instead. Back in August, someone fat finger listed their Bored Ape for $26,000, an error that someone else immediately capitalized on. The original owner offered $50,000 to the buyer to return the Bored Ape — but instead the opportunistic buyer sold it for the then-market price of $150,000.

“The industry is so new, bad things are going to happen whether it’s your fault or the tech,” Max said. “Once you no longer have control of the outcome, forget and move on.”