LONDON, Jan 31 (Reuters) – Stocks staged a modest rebound on Monday as traders put aside concerns about interest rate rises and the crisis in Ukraine to dip back in, but global equities are still headed for their worst January since 2016 after a bruising month.

The rise in European shares follows a late surge on Wall Street on Friday after a series of forecast-beating company earnings, including from tech giant Apple, helped stabilise investor sentiment after a series of volatile sessions.

Still, investors say the backdrop for equities remains uncertain as central banks tighten policy — the Bank of England is expected to hike rates again on Thursday — and another jolt higher in oil prices adds to inflationary worries. read more

Register now for FREE unlimited access to Reuters.com

Register

By 1115 GMT, the Euro STOXX (.STOXX) had gained 0.62%, the German DAX (.GDAXI) 0.64% and Britain’s FTSE 100 (.FTSE) 0.1%.

Lunar New Year holidays made for thin trading conditions in Asia. MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) closed up 0.68%.

S&P 500 futures pointed to a lower open while Nasdaq futures climbed 0.4%. The tech-heavy Nasdaq (.NDX) has borne the brunt of selling and is down 14% from a record peak last year.

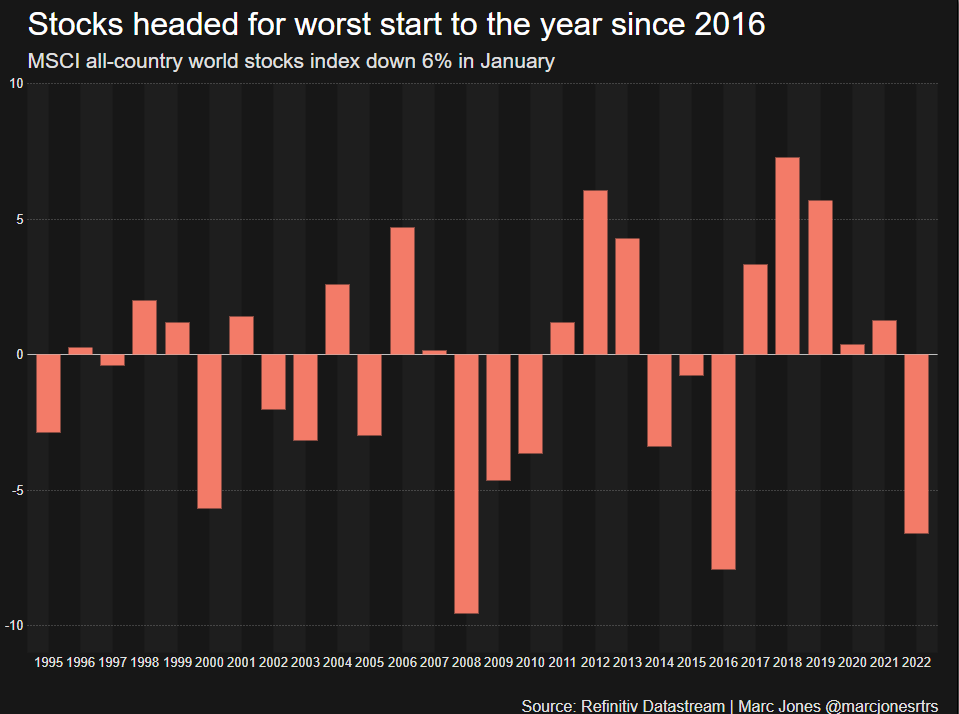

The MSCI World index (.MIWD00000PUS), while higher on Monday, remains down 6.2% in January – the worst start to the year since 2016. Before Friday’s rebound the index was headed for its worst January since the global financial crisis in 2008.

“This is not the classic selloff affecting lower quality underperforming companies. This selloff is driven not by fundamentals but by the action of central banks at a time when growth is very strong,” said Flavio Carpenzano, Investment Director, Capital One Group.

“For years you were like a spoiled child, you could get all the money you wanted and for free and you could buy what you wanted, you didn’t care that much about quality. Now it’s the other way round, you have to be more disciplined so you need to look carefully at valuation.”

ECB AND BOE MEET

The standoff over Ukraine also remains a thorn in the markets’ side, with concerns a Russian invasion would cut vital gas supplies to Western Europe. Moscow denies any plan to invade. read more

Oil prices reached new seven-year peaks on Friday, having climbed for six weeks straight as the political tension in Ukraine exacerbated concerns over tight energy supply.

Brent rose 0.68% to $90.64 a barrel on Monday, not far from Friday’s high of $91.7, while U.S. crude climbed 0.89% to $87.06.

In economic news, data showed euro zone economic growth slowed quarter-on-quarter in the last three months of 2021, as expected. read more

Data out on Sunday showed China’s factory activity slowed in January as a resurgence of COVID-19 cases and tough lockdowns hit production and demand. read more

Government bond yields in the United States held below recent highs , while in Germany the benchmark 10-year bond yield edged back above 0%.

Yields have jumped this year in anticipation of a faster rate of rate rises in 2022.

Markets have swung to pricing in five hikes from the Federal Reserve this year to 1.25% , though investors still see rates peaking at a historically low 1.75%-2.0%.

BofA economists think that is not nearly hawkish enough and expect seven 25 basis point hikes in 2022 and another four in 2023.

“We point out that markets have underpriced Fed hikes at the start of the last two hiking cycles and we think that will be the case again,” said chief economist Ethan Harris.

As well as the Bank of England, the European Central Bank meets this week but is expected to stick to its argument that inflation will recede over time. read more

Big data releases this week include the ISM readings on manufacturing and services, and the January jobs report.

The headline payrolls number is expected to be soft given a surge in coronavirus cases and adverse weather. The median forecast if for a rise of just 155,000, while forecasts range from a gain of 385,000 to a drop of 250,000.

Hawkish noises from Fed Chair Jerome Powell last week bolstered the U.S. dollar, which has jumped 1.5% this month against a basket of its main rivals to its highest since July 2020. It was last at 97.113 .

The euro has shed 1.8% in January to hit its weakest since June 2020. On Monday it rose 0.1% to $1.1163 .

The dollar gained versus the safe-haven Japanese yen, rising 1.3% last week and another 0.2% on Monday to 115.51 yen .

Register now for FREE unlimited access to Reuters.com

Register

Additional reporting by Wayne Cole in Sydney and Sujata Rao in London; Editing by Alison Williams

Our Standards: The Thomson Reuters Trust Principles.