How would you play two chess grandmasters, simultaneously? It isn’t that hard, even for someone whose opening game never developed beyond 1.e4. You let one grandmaster go first, use her move against the second grandmaster, see his reply, then use his move against the first grandmaster, and so on.

Similarly, investors are at the point now where they don’t have to figure out what the Federal Reserve is going to do or what Chair Jerome Powell will say, they just need to know what it will do, and he will say, relative to market expectations.

As Ryan Paisey, market commentator at PriaspusIQ, put it: “Given how hawkish the vast majority of the reads have been on today’s FOMC, there is a huge risk of disappointment. Powell sounding remotely neutral will be seen as dovish by many market participants. And should he actually be dovish…Feathers will fly.”

So let’s go through these possibilities, one by one.

Let’s dismiss the dovish possibility, outright. There is a dovish case to make — the first-quarter gross domestic product report may not have been as bad as the negative reading indicated, but the U.S. economy is undeniably losing steam, and consumer sentiment is in the toilet. Still, consumer prices just jumped 8.5% year-over-year, and the U.S. labor market added 431,000 jobs last month. It would undercut absolutely everything Powell has done since November to start talking dovish now.

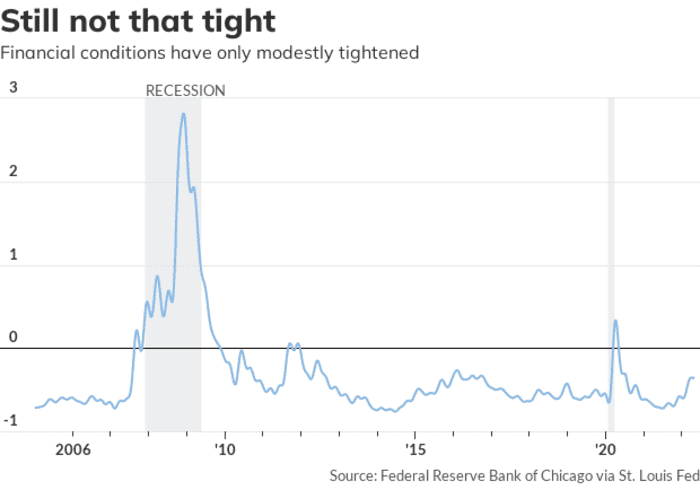

Besides, even after a dismal April in both the stock and bond market, financial conditions haven’t tightened very much. The Chicago Fed’s index of financial conditions, for instance, hasn’t even climbed above zero yet. “As you know, policy works through financial conditions,” Powell told Bloomberg’s Rich Miller at the March press conference. “We need our policy to transmit to the real economy. And it does so through financial conditions, which means that, as we tighten policy or remove accommodation so that it’s at least less accommodative, that broader financial conditions will also be less accommodative.”

So expect Powell to prepare markets for multiple, half-point rate increases to come. But they already are — expectations are the Fed funds rates will be between 3.25% and 3.5% by next March, compared with just .33% now. That would be four straight half-point increases, and then another four quarter-point hikes.

A natural question, given that the Fed will have likely moved from a quarter-point in March to a half-point hike in May, is why not go to a 75-basis-point increase in June. Tim Duy, the chief U.S. economist at SGH Macro Advisers, said a 75 basis-point rise would be a bad move, and would risk the Fed not just appearing panicky but causing a recession. Communication also would become a challenge, because hikes of those increments would quickly take rates to levels where the Fed would want to take its foot off the pedal, before economic data would be showing a significant slowing in inflation.

On the one hand, Powell risks sounding too dovish by pushing back against 75-basis-point expectations, and on the other, he could sound too hawkish if he says something like “all options are on the table.” Duy said the inverted yield curve story could come back into play if the market became convinced of a 75-point rise in June.

Nomura’s North American economists led by Aichi Amemiya, for their part, do expect 75-point hikes in both June and July, though they don’t expect Powell to explicitly say so. “A response that includes a reference to the 1994 tightening cycle, the last time the Fed raised rates by 75bp, would be a hawkish surprise, while a suggestion that 75bp hikes are unlikely to be appropriate would be dovish relative to our expectations. That said, given financial markets started to price in a 75bp hike in June, we believe there is little incentive for Powell to downplay the possibility of such a move,” said the team.

The buzz

The Fed decision is at 2 p.m. Eastern, when it is expected to lift rates by 50 basis points and also announce its bond selling plan, and the Powell press conference is at 2:30 p.m. There’s no dot plot this time around. Nothing really matters until then, but ADP reported a 247,000 rise in private-sector payrolls, while the Institute for Supply Management services index is due shortly after the open.

The European Union proposed a ban on Russian oil imports.

Lyft

LYFT

shares dropped 26% in premarket trade as the ride-hailing company said it would have to pay drivers more to meet demand, which will hit profitability. Rival Uber

UBER

lost more than forecast, but recorded stronger-than-forecast revenue as gross bookings rose 35%.

Advanced Micro Devices

AMD

rallied 7% after the microchip maker forecast annual revenue well above estimates. Airbnb

ABNB

also gained ground as the lodging booking company beat earnings expectations.

Moderna

MRNA

shares jumped as its earnings trumped expectations.

Elon Musk mused that businesses and governments may have to pay to use Twitter

TWTR,

as The Wall Street Journal reported that Musk may take Twitter public again in just a few years.

The markets

U.S. stock futures

ES00

NQ00

were leaning higher, after the second straight day of gains for the S&P 500

SPX.

Oil prices

CL

rose after the proposed EU ban on Russian imports. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was holding below 3%.

Top tickers

Here were the most active stock market ticker symbols on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| AMD | Advanced Micro Devices |

| NIO | Nio |

| AMZN | Amazon.com |

| NVDA | Nvidia |

| BABA | Alibaba |

| FB | Meta Platforms |

| MULN | Mullen Automotive |

Random reads

Comedian Dave Chappelle was attacked during a live performance at the Hollywood Bowl in Los Angeles.

A fake priest talked his way into the barracks of Windsor Castle.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.